The Kenya Revenue Authority (KRA) portal and the iTax online platform have made it much easier for taxpayers in Kenya to meet their tax-related obligations. One such obligation is filing tax returns, which have become simpler due to the helpful KRA iTax portal. It is the obligatory duty of every registered taxpayer in Kenya with their ‘Personal Identification Number’ (PIN) to file their tax returns at the end of every financial year.

Even for the unemployed, there is a type of tax return to fill. The iTax filing system has been created to accept different forms of tax returns. It is the taxpayer’s responsibility to recognize their tax type and file their return accordingly.

This task is compulsory for every registered taxpayer. Failure to file within the stipulated deadline or even file attracts specific punishments and might even be considered a crime. It is therefore advisable to learn the processes involved and file your returns as soon as possible.

Accessing the KRA Portal Can be Done by Visiting the Website

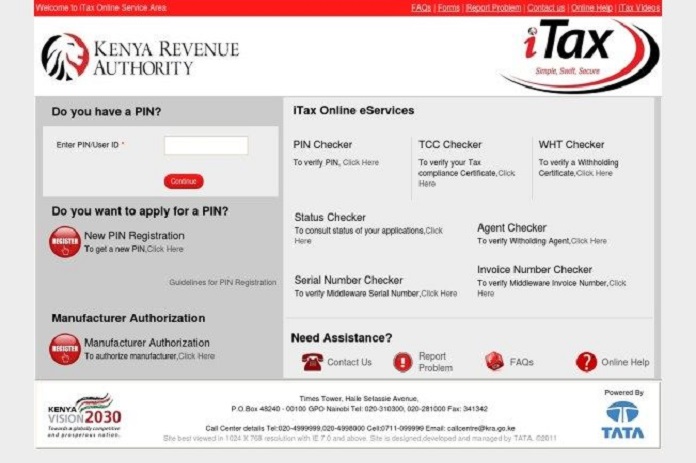

Seeing as the filing of tax returns process is an online process carried out on the KRA iTax portal, how to access it has become one of Kenya’s most asked questions. There is nothing complicated about this process, though, as all you need to access the KRA portal is the website link and your login parameters.

Your login parameters include a KRA PIN and your password. You also need to be able to do elementary arithmetic. The steps to get access to the KRA Portal and login in are:

- The first step is to visit the KRA iTax web portal using the URL link https://itax.kra.go.ke/KRA-Portal/. It is an external link that will take you directly to the KRA iTax portal.

- The next step is to enter your unique KRA Personal Identification Number (PIN). Peradventure you’ve forgotten your PIN. You can request retrieval, and your pin will be sent to your registered email address. Click on continue after you have entered your PIN.

- After entering your KRA PIN, you will have to enter your KRA password and solve a simple arithmetic question. The latter is known as a security stamp. If you have forgotten your password, you can request a reset. The KRA will send a new password to your registered email address. You can proceed to enter this new password and then click ‘login.’

- Once you enter your correct KRA password and solve the security stamp, you will immediately access your KRA iTax web portal account. It means you have successfully accessed the KRA iTax web portal.

Filing Your Tax Returns with the KRA

Now that you have successfully accessed your KRA iTax web portal, it is now time to begin the process of filing your tax returns. As specified earlier, the system recognizes and accepts filing from different types of tax returns. Here is how you can file your Individual tax and Pay as You Earn (PAYE) tax returns on the KRA portal.

How to File Individual Tax Returns on iTax

- Once you have successfully logged in, go to the returns menu and click on ITR for Employment Income only.

- Proceed to enter the return period.

- Answer ‘yes’ to the if you employment income question. Then click ‘Next.’

- Under the basic information section, answer the questions asked accurately and properly. Click ‘next’.

- Proceed to section F, which contains details of your employment income. Confirm your employers’ name, including their PIN, your gross pay, and other allowances as agreed with your employer.

- Proceed to sheet M where details of your PAYE are deducted. Once again, confirm employer details along with your taxable salary, chargeable pay, tax payable on your taxable salary, and the PAYE deducted.

- Move to sheet Q to confirm any payment you made before filing this return.

- Go to section T, which represents tax computation. Enter your pension contribution amount plus your relief.

- Click ‘submit’ and proceed to download the E-return acknowledgement receipt.

How to File Pay as You Earn (PAYE) Tax Returns

The PAYE is a tax deduction method on salaries of employees that applies to all income from any company or employment. The steps to file a PAYE returns on the KRA iTax portal are:

- Under the returns section, select the income tax, after which you choose PAYE

- Under the returns tab, select the ITR for employment income.

- Proceed to fill in the sections marked with red asterisks under Section A.

- Proceed to only fill two sections under Section T. These sections are 1.1 and 2.5.

- Move on to section F and fill out total employment income.

- Move to tab labelled section M and confirm that the taxable salary, tax payable on taxable salary, and tax deducted salary all match the information on the P9 form.

- Finally, move to section Q to fill in tax paid in advance if there is any. Once completed, click on submit.

- If you are successful, you will receive a ‘return slip generated’ tab. Proceed to download this slip.

Unemployed People have to File Tax Returns as Well

Filing of tax returns is not just obligatory for people with gainful employment. Unemployed folks, as well as students, are also mandated to file tax returns. However, they file different tax returns from what employed people file on the KRA iTax portal.

The minimum taxable amount in Kenya is Ksh 12000. If an individual makes below this or has zero income, they will file what is known as the Nil Returns. This return informs tax officials that the individual is either unemployed or a student. It is different from the tax returns type filled by employed individuals.

How to File Returns for Unemployed Individuals

The following process is how to file the nil returns for unemployed people:

- After logging in, scroll through the navigation tab and click on e-returns. It will open other options below. Scroll through options until you find ‘file nil returns.’

- Proceed to update the professions menu, then return to the file NIL return.

- For the taxpayer PIN, insert your KRA pin and input’ Income tax resident’ under the ‘tax obligation’ before submitting.

- The next thing is to fill in the returns period from and to within the obligation time frame. Then click the submit button.

- If successful, an acknowledgement receipt of the e-returns will be presented along with a successful submission message.

- Proceed to download the e-returns slip.

There are Consequences if you Fail to File Your Returns on Time

The KRA usually stipulates time frames for all registered taxpayers to file their tax returns on the iTax portal. Some individuals enjoy waiting until the deadline period to get things done, and all sorts of things can go wrong on that day.

To deter people from dilly-dallying, the KRA has put in place stiff penalties. Below are some of the punishable actions along with the penalties they carry:

- Failure to register as a taxpayer at all –fine amounting to Ksh 20000 or jail time for a maximum period of six months or both.

- Failure to submit a return before the due date or submitting a return without paying your due tax – default penalty of Ksh 10000 or 5% of the tax due plus an additional 2% interest for every month compounded.

- Forced registration – default penalty of Ksh 100000 is collected.

- Failure to keep accurate records – penalty fee ranging from Ksh 10000 to 200000.

- Fraudulent accounting – a penalty fee not surpassing Ksh 400,000 or double the tax fee evaded depending on which is higher. Jail time spanning a maximum of three years or both.

- Failure to issue tax invoice – default penalty not below Ksh 10000 and not surpassing 100000.

- Failure to display a certificate of registration – penalty fee between 20000 – 200000 or imprisonment not exceeding two years or both.