Every bank or financial institution has official routing numbers and in the case of Equity Bank Kenya, the number is 101105354. This is a unique nine-digit figure used for multiple purposes and you cannot carry out certain transactions effectively without involving the routing number. It’s a form of identity for your financial institution and it says exactly where a transaction is originating from. For this piece, we have x-rayed the meaning of routing numbers, their uses, and how to get them.

What Does Bank Routing Number Mean?

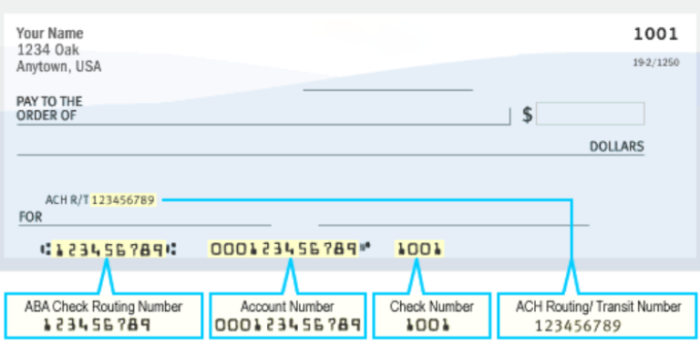

When an account holder of a bank is trying to make a transaction, several numbers may be involved. In the case of check issuance, you will see a line-up of numbers at the bottom of the check leaf and one of them, usually the first from left, is the routing number.

The routing number is also referred to as the Routing Transit Number (RTN); it is equally called an ABA routing number, and it comes in the form of a nine-digit number identifying the financial institution involved in a transaction. It also functions to identify the particular location where your account is domiciled.

Banking transactions come in several types but the most common among them is the ACH which means Automated Clearing House (it has a number tagged Automated Clearing House number) and wire transfers. These require the use of a routing number.

When a customer is making payments, either online or via phone, he or she will always be required to produce their Checking Account Routing Number. This makes the transaction go seamlessly without any hitch.

Some Financial Institutions Have Official Routing Numbers For Different Locations

Equity Bank does have an official routing number which is 101105354. With this number, the bank’s customers will be better equipped to carry out transactions from any location at any time.

However, there are financial institutions that prefer to use several routing numbers, each dedicated to different purposes. These numbers serve different branches, as well as geographical regions. In this type of situation, the onus is now on the customer to ensure that they use the correct numbers for each region, purpose, or branch as the case may be. Thus, before trying to initiate any transaction at all, make sure that the right number is handy.

When Does A Customer Need To Make Use Of The Routing Number?

Situations that call for the use of the bank’s routing numbers are numerous but the major ones include:

- When a customer wants to set up direct deposit

- When they wish to make automatic loan payments

- While making recurring transfers; these include things like bill payments, purchases, and the likes

- The routing number is also needed when customers file taxes in order to receive their tax refund. Also, it can be used to debit a tax payment

- Another instance where routing numbers must be used is when you are conducting ACH (Automated Clearing House), transfers from one bank account to another

- Generally, the movement of funds into or from your bank account calls for the use of your Equity Bank routing number

- However, the number is not needed in credit card or debit card purchases

Where To Find The Equity Bank Routing Number

On Every Check Leaf

A bank’s checkbook contains many check leaves and on each leaf, you will find many numbers on the bottom. From left to right, you will see:

- ABA Check Routing Number

- Account number

- Check number

- ACH Routing Transit Number

Your Equity Bank routing number is the first one on the bottom left. However, it is important to note that there are cases where the order of the numbers may be reversed.

Through the Bank’s Online Banking Portal.

If you are in a situation where you need to make urgent use of your Equity Bank routing number, there is no need to panic, just log on to their online banking portal and you will have it in a jiffy.

Through Your Statement Of Account

Just like the checks issued by the bank, every single statement of account also bears the routing number. Just keep one within reach and have constant access to it.

Through The Bank’s Customer Service Agent

This is the age-old way of accessing any important information from the bank, including the routing number. Once you get in contact with a customer service officer of your bank, you can ask for the routing number and get it within seconds.

Through Fedwire / American Banking Association

Another effective way of accessing your bank’s routing number is to check with the Federal Reserve’s official website or the American Banking Association.

FAQs About the Equity Bank Routing Number

What is the official routing number for Equity Bank?

Your Equity Bank’s official routing number is 101105354 and it is a nine-digit number with the major function of identifying the bank or financial institution involved in a transaction. It also identifies the particular location of the financial institution or bank where an account is domiciled.

Why would you give your routing number and account number to someone?

When someone wants to transfer cash or deposit checks into or out of your account, then your routing number is required. This can be used for social security payments, direct deposit of paychecks, utility payments, and things like that.

Are there other names for a bank’s routing number?

Yes, there are other names; when you see names like RTN (Routing Transit Number) or ABA Routing Number, they are all talking about the same thing.

How do I access my Equity Bank routing number?

Accessing your Equity Bank routing number is very easy and with technologically advanced online banking, the number is almost ubiquitous. It is on every check leaf, on every statement of account, and on the online banking platform. What’s more, the routing number can be easily accessed by placing a call to your bank’s customer service officer or visiting the banking hall.

When does a customer need to make use of the routing number?

The routing number is needed when a customer wants to set up direct deposit, when they wish to make automatic loan payments, and while making recurring transfers like bill payments, purchases, and many more.