Federal Inland Revenue Service (FIRS) is the Nigerian government organization responsible for generating revenue through taxation, and they issue a unique number called Tax Identification Number (TIN). If you do not pay your taxes, the government agency that oversees taxes — the Federal Inland Revenue Service (FIRS) — will require you to pay your taxes or else face penalties, such as fines or going to jail.

Every government needs sustainable funding sources to foster economic growth and development through social programs and public investments. Taxation not only pays for public goods and services; it is also a key ingredient in the social contract between citizens and the economy. Taxpaying is considered a civic duty, although doing so is also a requirement of the law. The money you pay goes a long way in bringing about public development. In addition to paying government workers’ salaries, your taxes also help to support common resources, such as police and firefighters. Taxes are also used to fund many government programs that help the poor, less fortunate, and many schools.

What is TIN, and Who is Eligible for the Number?

The Tax Identification Number (T.I.N.) is a 14 digit number generated electronically as part of the tax registration process and assigned to all taxpayers, companies, enterprises, or individuals for identification. This unique number fondly called TIN is generated by the Tax Authority for proper identification, order, and ensuring that more people are brought to the tax net. The number is also issued through the Joint Tax Board portal online or through an application letter to Federal Inland Revenue Services’ office nearest to your location.

TIN is free and can be obtained either for an individual or for Organisations. These numbers are used by employers, sole proprietors, corporations, partnerships, nonprofit associations, trusts, estates of decedents, government agencies, certain individuals, and other business entities. It is, therefore, imperative that you obtain your TIN, especially if you have a business, as it is mandatory for corporate entities to provide a TIN before opening or operating a corporate account in any Nigerian Bank. Other things you can easily get with your TIN include

- Certificate of Occupancy,

- Government loan,

- Application for import and export licence,

- Vehicle license

How to Generate TIN for Individuals

Individuals can apply for their TIN on the Joint Tax Board website with their National Identification Number (NIN) or BVN (Bank Verification Number). You can also visit the nearest Federal Inland Revenue Service (FIRS) with the following items:

- Utility Bill,

- Valid ID (Government Approved)

- A Passport Photograph.

TIN online verification for Individuals

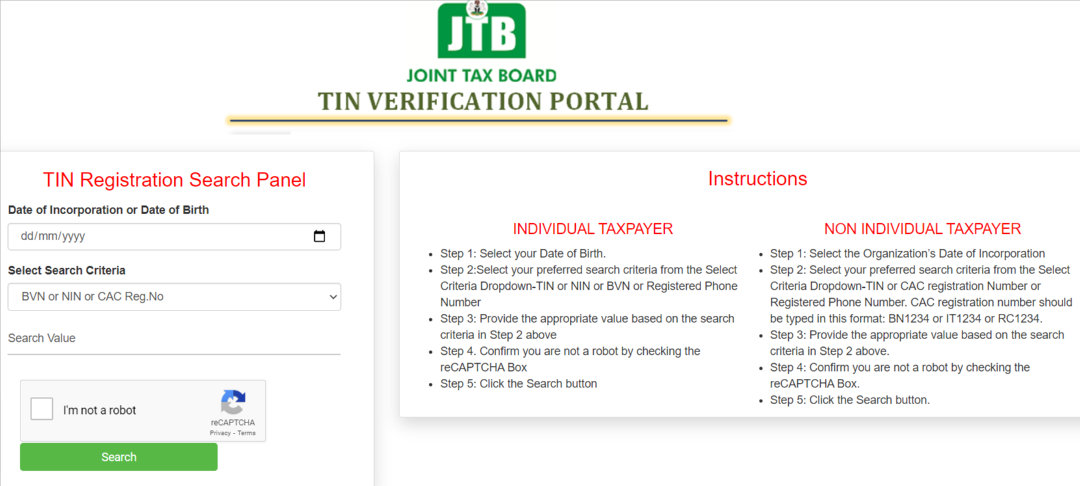

You can check online to see if you have an existing TIN by clicking on the FIRS TIN verification System to verify a TIN, search using your BVN or Registered Phone Number, and your Date of Birth.

How To Generate TIN for Non-individuals

Non Individuals like Limited Liability Companies, Incorporated Trustees, Enterprises, Cooperative Society, MDAs, and Trade Association, etc. who are registered at the Corporate Affairs Commission (CAC) can register for their TIN on the JTB website with the Director’s valid ID, BVN, or NIN, and Certificate of Incorporation. Your request will be verified and approved. TIN Certificate will be automatically sent to your registered email, or you can pick up a hard copy from the FIRS Office near your registered address.

Alternatively, you can visit any of the FIRS offices near you with an original copy and two photocopies of the following documents:

- Memorandum and Articles of Association

- Certificate of incorporation (CAC2 & CAC7)

- Company Seal,

- Application Letter using the company’s Letter-headed paper

- Duly completed TIN application Form

- Utility bill

TIN online Verification for Companies and Businesses

To verify if your company or business name already exists on the TIN joint tax board, the following will serve as a guide:

-

-

- Visit the Joint Tax Board Verification portal

- Select the Organization’s Date of Incorporation.

- Select your preferred search criteria from the Select Criteria Dropdown-TIN or CAC registration Number or Registered Phone Number. You should type the CAC registration number in this format: BN1234 or IT1234, or RC1234.

- Provide the appropriate value based on the search criteria in Step 2 above.

- Confirm you are not a robot by checking the reCAPTCHA Box.

- Click the Search button.

-

What is the Cost of Getting a TIN

Applying for your TIN both for individuals and companies/ businesses is absolutely FREE. This means that the Joint Joint Tax Board does not request any fee before you obtain the TIN, and since the whole process is extremely simple, you may not need to employ someone to apply on your behalf. However, the help of a third party may be required to assist.

How Long Does it take to get a TIN in Nigeria?

It should take only minutes to get your TIN from the moment you apply for it online, but following FIRS’s struggle with backlogs, the process may take from a few days to about 10 days. However, these terms may vary. Sometimes it is quicker; sometimes, it can take longer (even for 1-2 months). Anyway, when your tax number is ready, you should be notified.

Risks that Comes With Giving out your Tax ID Number

TINs are issued to individuals as Social Security numbers (SSN) and businesses as Employer Identification numbers (EIN). These numbers are vulnerable to theft in numerous ways, including being hacked from a computer network. When not protected, it could fall into the wrong hands. Anyone who got your Tax ID number can do the following with your information:

- Can use the information to access bank accounts,

- Can lead to illicit withdrawals and expenditures and fictitious insurance accounts used to obtain fraudulent prescriptions and services.

- Can create duplicate credit cards,

- Can apply for loans and make fraudulent purchases in your name.

Can I get a FIRS TIN Number without a job?

The Tax Identification Number is a unique number issued to every tax-paying citizen in Nigeria; hence, it is not only for employed individuals. Every Nigerian who sells products and services, runs his or her own business, is working for the government, public, or private enterprise, or is involved in a free-lance system is expected to have this special number. Anyone can apply for a TIN, including students and unemployed individuals.