The call for a cashless economy necessitated certain changes in society as well as in the financial institutions that are offering these services to the public. PayPal which is one of such institutions is notable as an online payment company that supports the transfer of funds between members, for personal or business transactions. PayPal also stores passwords for its customers – for these two services it renders, the company collects a small fee for it. To promote the cashless economy trend, PayPal accounts can be funded by credit/debit cards, other PayPal accounts, bank transfers, and even via M-Pesa.

Beyond funding PayPal accounts, M-Pesa also happens to be a mobile bank – it offers most of the services a bank offers without the stress of writing checks and going distances to access your funds. This fast-rising financial service provider is owned by Safaricom, the biggest telecoms provider in Kenya.

Steps To Link Your PayPal Account To M-Pesa Account

As mentioned earlier, PayPal and M-Pesa happen to be two financial institutions one can turn to for a variety of financial cashless services. Although functioning at different capacities, these two platforms offer similar financial services to their customers.

Whether it’s online payments or getting access to loans, they bring these ervices to you just from the click of a button. More so, PayPal accounts can be funded with M-Pesa accounts, and this goes both ways all thanks to ‘TransferTo’ which is a business-to-business payment and money transfer connector. It easily connects PayPal accounts to M-Pesa accounts; however to enjoy this benefit, certain requirements must be met, and the steps to link these accounts are as follows:

1. Go to the link: https://www.paypal-mobilemoney.com/m-pesa

2. Log into your Kenyan PayPal account. You will have to agree to TransferTo’s terms and conditions for using the service.

3. Add the M-Pesa number you’d like to link to the PayPal account.

4. Wait for a few seconds in order to receive a verification code on your Safaricom line via SMS text.

5. Type in this code to complete the link. The process will be complete in a few seconds and you can proceed to withdraw or deposit from your PayPal account.

N.B. You must have a Kenyan PayPal account. Trying to link any account that isn’t Kenyan won’t work.

Steps To Open A Kenyan PayPal Account

1. Visit Paypal Website – www.paypal.com/ke and select the signup button.

2. Choose the PayPal Account Type Your Want To Open – that is either a Personal or Business account.

3. A list of questions about your personal details will be requested like: name, email address, desired password, national ID/Driver’s License/Passport ID (any of these), postal/home (physical) address, birthday, and phone number.

4. Upon providing valid information for the above, accept PayPal User Agreement terms, and Create Account.

5. When your account has been set up, link your debit card to your bank by entering a code sent by PayPal which will be sent to you via SMS.

6. Enter the code to verify the details of your debit card.

7. Verify your email address as well as phone number via the link and code PayPal will send to your email and phone respectively.

8. Via the link in your mail, you will be redirected to the PayPal website.

9. Enter the code in order to verify your phone number.

How To Send Funds From PayPal to M-Pesa

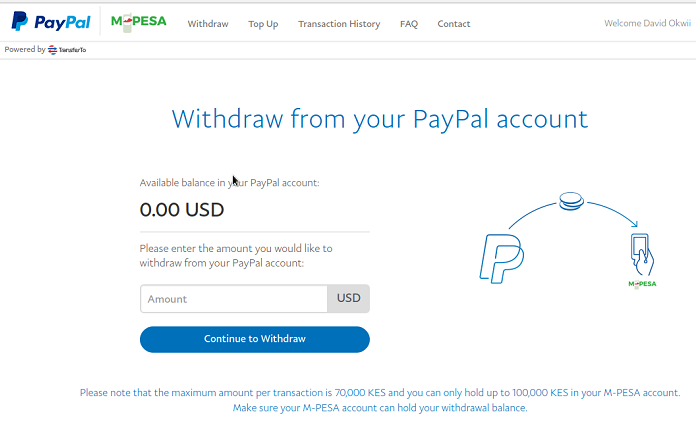

1. Click on the link https://www.paypal-mobilemoney.com/m-pesa and Log in to your PayPal account where you select the “withdraw from PayPal” button.

2. The available PayPal balance will be displayed.

3. Enter the amount you would like to withdraw from your PayPal account in USD.

4. You will be redirected to a page showing the amount to be received in Ksh., the exchange rate used for the currency conversion, and the estimated transaction processing time.

5.Confirm and complete the withdrawal of fund

N.B. Currency conversion is necessary for making this transaction

How To Send Money From M-Pesa To PayPal

1. On your M-Pesa- PayPal web page, click on Top Up and enter the USD amount you would like to send to your PayPal account in order for you to get the equivalent in Ksh.

N.B the foreign exchange rate will be shown on the page.

2. Proceed to select Lipa na M-PESA then enter the Pay Bill option.

3. Type in the Business code, 800088.

4. Type in your phone number as the Account Number.

5. Enter your M-PESA PIN and then click on the Send button.

6. You will receive an SMS confirming that USD xxx was added to your PayPal balance. You can monitor the status on the Transaction history page

M-Pesa Charges For Its Transactions To and From PayPal Accounts

M-Pesa just like any normal business is profit-oriented, their charges aren’t steep but it’s still there. For M-Pesa to PayPal – due to the difference in currencies, a calculator is provided on the site for any transaction that the customer might want to do. After making the proper assessments the customer is charged 4% of the total funds that are involved in the transaction. Meaning that there is no fixed amount, the more the customer withdraws, the higher the fee.

For PayPal to M-Pesa – just like the previous transaction, the fee for this is also in percentage; 3% of the total funds is the fee. Needless to say, that the foreign exchange calculation is involved as well.

Issues That May Arise When Transacting Across The Platforms And How To Resolve Them

Like every other electronically operated system, customers usually experience a few challenges when transacting across these platforms. One such is the slight changes personal details section which affects a good number of M-Pesa users who want to link their account to PayPal accounts. However, this can be resolved by opening a PayPal account with the exact details you have on your M-Pesa account and it will work perfectly fine. Better still you can contact PayPal to sort it out via this link – https://www.paypal-mobilemoney.com/m-pesa/contact

More so, due to some challenges of conversion, it is likely to experience up to 4 hours delay while sending funds from your M-Pesa account to your PayPal account. This usually occurs when the balance in your PayPal account is not in USD. To enjoy a swift service and real-time processing of transactions, ensure your PayPal account is in USD.

A couple of other challenges may arise if users are not aware of the maximum transaction limits per transaction set by PayPal and M-Pesa. At the moment, they are Ksh.150,000 per transaction and Ksh.300,000 per day. With these in mind, transactions should be tailored to fall within these ranges for easy processing.