The National Industrial Credit (NIC) Bank ranks as one of the notable financial institutions in Kenya, catering to the needs of the teeming Kenyan populace since its establishment. It has launched several user-friendly services to serve its customers more effectively, and one of the best services you can ever have as a NIC customer is its online banking service. This platform will give you access to many services from any location in Kenya without going to the banking hall. These include checking your NIC account balance, viewing your bank statement, viewing your transaction history, paying bills, sending money, and much more. However, before you can use all the services mentioned above, you must register for the online banking service. Signing up for NIC Bank’s e-banking service in Kenya is relatively easy.

What Do I Need To Register For NIC Online Banking?

Before you can access the NIC online banking platform, there are a couple of things you must have. They include:

- a NIC Kenya bank account

- you must provide your full name

- a valid phone number

- an active and valid email address

- a valid identification number (ID)

Steps To Enroll On The NIC Online Banking Platform

If you are already a NIC customer and wish to gain access to its online banking service, you need to register precisely for NIC Bank Kenya online banking. The following steps will get you started on the process:

1. You can visit any NIC Kenya Bank branch nearby or call the NIC bank customer care unit on +254 20 2884444, +254 711 056444, and +254 732 156444. More so, you can do so by using the NCBA group page for online registration and provide your account number and phone number for validation.

2. Using any of the aforementioned options, you can go ahead to request the online banking registration form.

3. The form will be provided for you and once you receive it, fill in the necessary information as asked in the NIC bank Kenya internet banking application form.

4. The completed form should be submitted to the bank for them to assess your application – your registration is considered successful if it is approved after the bank’s assessment.

5. Once your application is approved, you will be given your login details

How Do You Login Into The NIC Bank Online Platform?

After successful registration, you can go ahead to log into your NIC internet banking account to make use of the numerous services it offers. The steps below will get you started on the process:

- Go to the official NIC Bank Kenya website which is the NCBA group page

- Navigate to the section that has the ‘Internet Banking’ icon and click on the drop-down arrow under it

- Select the option for online banking and click on ‘Got For It’

- You will be redirected to the online login page

- Navigate to the section on the left-hand side and enter your User ID and underneath it in the other box, provide your ‘Token Generated Pin’

- When you have keyed in the above details, click on ‘Go For It’ and follow the steps to sign in to your NIC online banking account

The Procedure To Reset Your NIC Online Banking Password?

To reset or change your NIC internet banking account password in Kenya, follow these steps.

1. Send an email to [email protected]

2. In the mail, request to change your online banking account password

3. Provide the necessary details to authenticate your account

4. Comply with the next instructions to change your password

5. When the issue is resolved, log in with your new password to see it works

What Transactions Can Be Done On The NIC Internet Banking Platform?

NIC bank provides a long string of services on its online platform to make it easy for its customers to access banking services no matter where they might be. Some of these services that are on the NIC online banking platform include:

- Viewing statement of account

- Viewing account balance

- Making payments to other banks

- Requesting bankers cheque

- Paying bills

- Mobile money transfer service

- Making international transfers

- Making domestic EFT transfers

- Internal fund transfers between NIC bank accounts in Kenya and other countries like Tanzania and Uganda

- Assessing standing orders.

What Is The Significance Of The Swift Code?

A swift code, which is also known as a swift number, is a standard format for business identifier codes. Financial institutions, banks especially, use these codes to identify themselves globally. That is, it is a kind of international bank code used for identifying a bank overseas.

There are numerous things this code is used for but the basic one includes transferring money between banks, especially in international transfers. It can also be used by banks to send messages across to each other with respect to an international transaction.

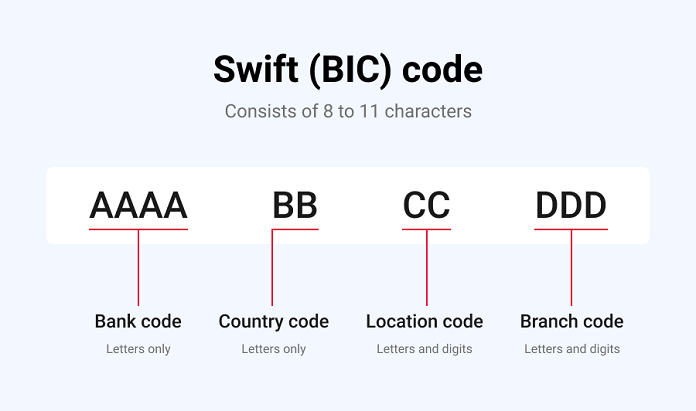

The makeup of the swift code is such that it identifies the country, city, bank, and branch from which an international transaction is made. The code usually has about 8 to 11 characters which are:

- Bank code: these are 4 letters representing the bank undertaking the international transaction. It is actually a shortened version of the bank’s name.

- Country code: these are 2 letters representing the country the bank is operating from

- Location code: 2 characters made of either letters or numbers showing among the SWIFT code is used to show the location of the bank’s head office

- Branch code: 3 characters in the Swift code are used to represent the particular branch of a bank that is involved in the international transaction

How Do You Find The NIC Bank’s Swift Code?

Like all banks, NIC’s swift code can be found on the internet and you can get it by simply searching for it online. It can also be found on your bank statement and on your check booklet if you have a current account.

The NIC bank swift code appears in this pattern: NINCKENAXXX where:

- NINC represents the bank name

- KE is used to represent the country code (that is, Kenya)

- NA is used to represent the location code (in this instance Nairobi)

- XXX is the branch code and it is represented like this because every branch has their own unique code.