Registering for the Fuliza M-Pesa initiative to secure loans is very important for people who might find themselves having insufficient amounts frequently. With Fuliza M-Pesa, you can now complete transactions on M-Pesa despite having insufficient balance.

Individuals might borrow money from loan services like Mshwari, Eazzy, or Tala to offset bills and complete transactions. However, they come with many terms, high-interest rates, and short repayment windows. The introduction of a short-term overdraft service like Fuliza creates more comfort for customers. It allows them to complete many of their transactions even with an insufficient amount in their account.

What is Fuliza M-Pesa?

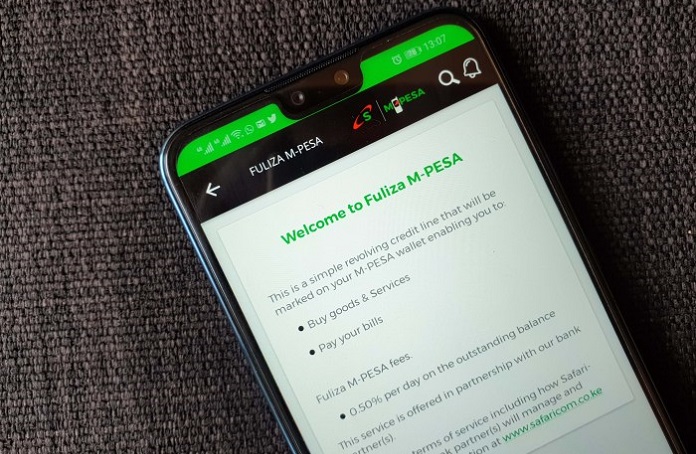

Fuliza M-Pesa is a loan service in form of an overdraft facility available to all M-Pesa subscribers. It gives subscribers the ability to complete their transactions despite having an insufficient balance. It provides a customer with the additional funds needed to ensure that a transaction goes through or is completed.

Fuliza generally works as a bank overdraft. This service was created by the Commercial Bank of Africa (CBA) and offered through Safaricom’s M-Pesa, a mobile money service. Although the product is popularly referred to as Fuliza loans in Kenya, it is advisable to note that it is not a loan service. Safaricom has described it as a ‘continuous overdraft service.’

How does it Work?

The working mechanism behind the Fuliza M-Pesa is not very complicated to understand. It has a fundamental principle of just bridging the gap between the amount needed to complete a transaction and the amount currently available. In simpler terms, it means that if a customer seeks to purchase an item and they do not have enough money for it, Fuliza M-Pesa funds the difference. You can use Fuliza M-Pesa loan service to:

- Send money to both registered and unregistered M-Pesa users

- Make payments through every single Lipa na M-Pesa transaction carried out by a customer

It is important to note that while a user can send money and make payments using Fuliza M-Pesa, the Fuliza funds can’t be withdrawn. It means the money in your Fuliza M-Pesa account can only be used for online transactions. You cannot have the cash in your hands.

Here’s How to Register for It

Now that you have read all about Fuliza M-Pesa and what it is about, it is time to learn how to register for the service if it is something you wish to subscribe to. The registration process for Fuliza M-Pesa loan service is very simple and straightforward. To register, you need to be an M-Pesa user with an active Safaricom line. Once this is done, simply:

- Dial *234# from your Safaricom line

- Select Fuliza after

- Follow the prompts until you are registered

- That is it. You are now subscribed to the Fuliza M-Pesa service

The process of applying for a loan and the requirements needed are the same as registration. To apply for a Fuliza loan, simply follow the step-by-step guide above and ensure you meet the requirements.

Fuliza M-Pesa Loan Terms and Conditions

Speaking of requirements, it is important to read the Fuliza M-Pesa terms and conditions before registering to use the service. This is because there is some information there that will help you decide if you want to use the service or not. It will also inform you why certain things happen so as not to be confused when they do. The terms and conditions are broken into other categories:

Requesting a Facility

- A facility means the funds that are given to you by Safaricom to complete your transaction.

- You can only apply for a facility if you have an insufficient balance

- After registering, you will get a confirmation message from Safaricom containing your overdraw limit. Your overdraft limit is the maximum amount of money you are allowed to request for in the Fuliza M-Pesa service

- If you do not get one, continue using the M-Pesa service more regularly to get a good credit score and a reasonable overdraw limit.

Overdraw Limit

- Your overdraft limit will be reviewed from time to time by Safaricom. It might increase or decrease depending on how frequently you use the service and how diligent you are in repaying.

- If you have not paid your outstanding loan balance after 30 days, Safaricom will withdraw your access to the Fuliza M-Pesa service until you and improve your standing.

Defaulting

- If you fail to repay your facility after 30 days, you will be deemed to have defaulted payment

- Safaricom will terminate your service and suspend your ability to register again

- The company may also use other measures to recoup their facility if the customer remains uncooperative. The use of an independent debt collector may be deployed.

How to Check Your Fuliza M-Pesa Limit

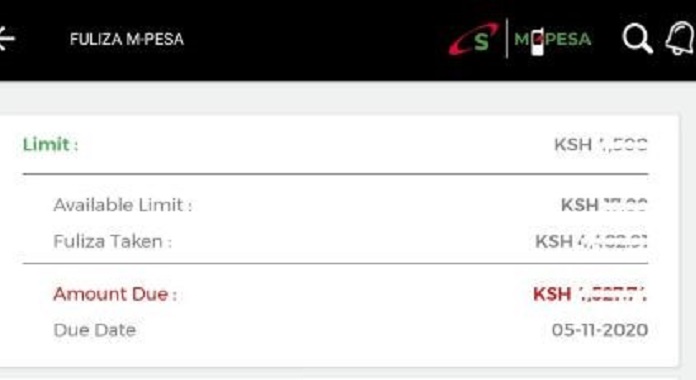

The Fuliza M-Pesa loan service comes with overdraft limits for subscribers. These limits might differ from one subscriber to another depending on how frequently the Safaricom and M-Pesa services are used. Knowing how to check your limit is important. It informs you of the maximum amount you are allowed to request and helps you tailor your transaction activities.

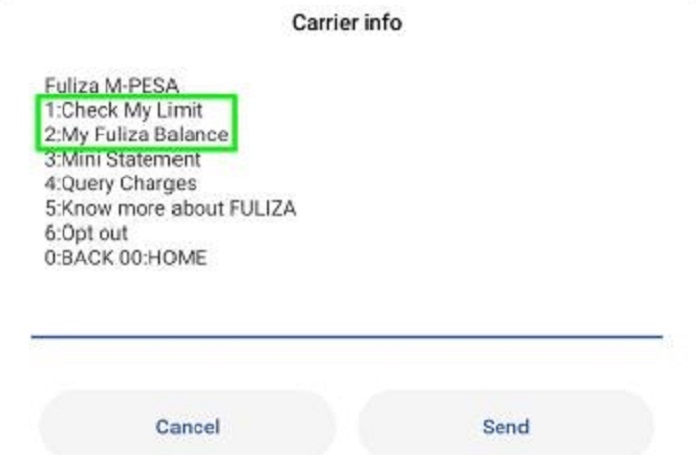

You can check your limit by using USSD:

- Dial *234# from your Safaricom line

- Select 0 in the next option

- In the next menu, select 1 to check your Fuliza limit

- Alternatively, you can select 2 to check your Fuliza balance

Or, you can check your limit by making use of the MySafaricom app.

To use the app, just follow the steps below:

- Download the app from either the Google play store or app store

- Install on your phone

- Launch the app and login with your details

- Click on the M-Pesa tab menu

- Select the Fuliza M-Pesa sub-menu

- You can now view your allocated Fuliza limit and also your available balance

Fuliza M-Pesa Repayment

The repayment policy of the Fuliza M-Pesa loan is relatively straightforward. After applying for and using the service, any amount you receive in your account is automatically debited towards repaying your debt. This means that as soon as you deposit any money into your M-Pesa account or sent money, that money will be deducted, and your account debited.

Safaricom will debit you the amount they made available to you plus a small facility fee or interest. If the money sent or deposited is lower than the amount used in your Fuliza M-Pesa, the whole amount in your account will be deducted. The remaining balance will be debited whenever you deposit money in your account again. A customer usually has a repayment window of 30 days. If it exceeds this, the customer is termed to have defaulted on payment.

Service Fees and Interest

When you use the Fuliza M-Pesa loan service, the standard M-Pesa transaction fees will be deducted, as with other M-Pesa services. Additionally, you will be charged maintenance and access fees of 1% on your remaining Fuliza M-Pesa balance. To see more about the service and interest fees charged, take a look at the table below:

| Range | Tariff | Promotional Tariff for 30 days from Launch |

| 0-100 | One-time fee of Ksh 2 | One-time fee of Ksh 0 |

| 101-500 | Ksh 5 per day | |

| 501-1000 | Ksh 10 per day | |

| 1001-1500 | Ksh 20 per day | |

| 1501-2500 | Ksh 25 per day | |

| 2501-7000 | Ksh 30 per day |