Making funds transfers from M-Pesa to an account in the bank or from the bank to M-Pesa is considered to be a form of mobile banking, M-Pesa has taken care of the need to be physically present in the banking hall and possibly spend hours in the queue. Owning an Equity bank paybill number will enable users to make money transfers via M-Pesa at any time, irrespective of your location, be it your home, office, local café, and even in transit. Now if you are interested in leveraging M-Pesa to transfer funds to Equity Bank, read on to get the full details, including the charges that are accruable.

Money Transfer from M-Pesa Using an Equity Bank Account

Do you have an Equity paybill number? if you do, then it’s time to enjoy that unique opportunity of transferring funds from M-Pesa to an Equity account, it is quick and it is easy. To successfully conclude a transaction, an Equity bank account, as well as Equity M-Pesa paybill number, must be in place. In the absence of these, you can seek the assistance of Equity staff to register with the bank.

With the advent of Safaricom M-Pesa, queuing up at your local bank is a thing of the past, you can now sit in the comfort of your office, home, or even car to effect funds transfer from M-Pesa to an Equity account. To be frank, making money operations is now possible no matter the time and location.

This unique option enables users to pay certain bills like communal payments, tuition, NHIF contributions, and more. Now, how do we go about transferring funds from M-Pesa to Equity? The steps are listed below but before commencing, be sure to acquaint yourself with the relevant charges and you can find this on safaricom.co.ke which is their official site.

Step by Step Guide on Effecting Money Transfer from M-Pesa to your Equity Bank Account

• First a personal M-Pesa account has to be in place for anybody that would love to transact. You can leverage your smartphone or notebook to access your account. Smartphone users can take advantage of a special mobile application for M-Pesa targeted at IOS and Android users. A visit to the M-Pesa official website is a must for users of notebooks.

• If your personal account is already existing, just go ahead and log in. This can be accomplished by imputing the required info in the login fields. The information can come in the form of user ID, password, phone number, and more.

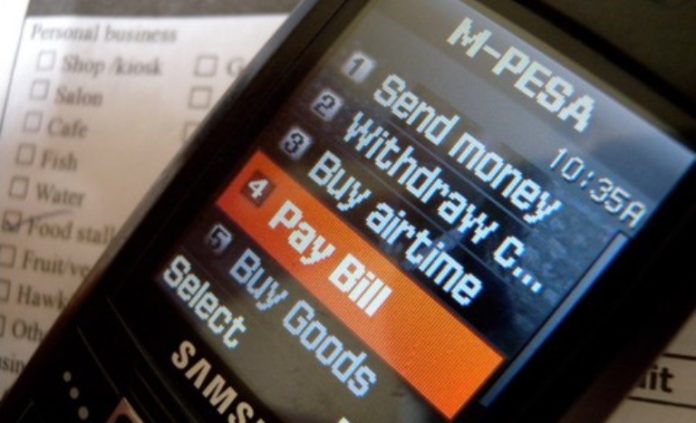

• After logging in, go to the menu list in the right corner and access “Lipa na M-Pesa”.

• This opens a new window bringing multiple options such as M-Pesa services, corporate account, paybill, M-Pesa 1 Tap, etc. The “Paybill” button is the right one to click on.

• Go to the business number field where you are required to cue in your special Equity Bank M-Pesa paybill number – 247247. Always have this number verified to avoid issues later.

• With that accomplished, cue in your personal Equity bank account number in the provided account number field. Then the bank account of the person or organization that will receive the money is required if the money is going out.

• Now, the exact amount of money you wish to transfer should be cued in. Ensure that your M-Pesa account has enough funds to accomplish the operation, 1.e, take care of both transfer and charges.

• Having said that, it is time for you to punch in your personal M-Pesa PIN.

• Hit on the “Send” button. An SMS will appear from Equity bank within two minutes showing details of your transaction like the amount, time, and more.

• After you have clicked the “Send” button, a popup comes up immediately, requesting that you verify the transaction details. Once you are satisfied with everything, click the “Agree” button.

• In no time at all, your mobile device will receive an SMS from M-Pesa, showing a successful transfer of funds from M-Pesa to Equity.

These are the Charges to Expect

People who wish to leverage M-Pesa to transfer funds to Equity bank should know that charges are not applied as the transaction is absolutely free. However, the sending telecom company (in this instance Safaricom) levies charges. Though the charges depend on the sum of the transaction and you can find out how much to pay by leveraging the Safaricom M-Pesa charges calculator.

The calculator is a user-friendly tool that users leverage to calculate charges for M-Pesa to Equity account transfers, ATM charges, and many more. The calculator is accessible on Safaricom’s official website, you can also get it from other internet sources.

Visit safaricom.co.ke and go to the bottom right corner very close to “Find Your Bank Code”, there you will find “Get M-PESA Rates”. Now, select the option that you need from the drop-down list tagged “Transaction”. The options include

• Withdrawal from M-Pesa agent;

• Transfer from unregistered User;

• Transfer to other M-Pesa users;

• ATM withdrawal.

Beneath the drop-down list tagged “Transaction” is another important field tagged “Enter Amount”. This is where to cue in the amount, to transfer to Equity bank via M-Pesa. The “Find Rates” button is a big dark grey button at the bottom. Click on it and within seconds, the charges applicable for M-Pesa to Equity account will appear.

For instance, someone wishing to transfer the sum of 2000 ksh to Equity bank via M-Pesa will cue in the amount after choosing the required transaction option. This will generate a fee of Ksh.73. What this means, in essence, is that, for you to successfully transfer the sum of Ksh.2000 your M-Pesa account has to be funded up to the tune of Ksh.2073 in the least.

Note that the M-Pesa calculator is accessible from numerous websites, but your best bet is to leverage the one on Safaricom’s official website. The reason is that they are fast in updating data in the case of rate decrease or increase.

What to do if Issues Crop Up

From the above explanation, you only get to spend a minimum amount of time on the transaction process as it has been greatly simplified. However, it is very important that you receive an SMS at the end of each transaction. If this message is not forthcoming either from Equity or M-Pesa within two hours, the onus is on you to go back to your M-Pesa account to check the balance. If it happens that the money was not debited, you can try repeating the process.

Though it is better to err on the side of caution by first contacting the support services attached to M-Pesa; there, you will get to the root of the problem and know the next course of action. For the contacts of the support services, go to the official website of Safaricom; their turn-around time is just two minutes and you will get help for whichever problem you are encountering. Important to note that the success rate of transferring from M-Pesa to Equity is 99%, thus, these issues may not even arise.

In addition, users have to try and avoid encountering unpleasant surprises by first checking the charges for any transaction they want to make.