Founded in 1990, Zenith bank has largely grown to become one of the leading financial institutions in Africa and one of Nigeria’s biggest banks. It has its subsidiaries in Ghana, China, Sierra Leone, and The Gambia while making concrete plans to have branches in other African countries, as well as Asian and European nations.

Meanwhile, swift and sort codes are two ways to identify a bank. The codes are primarily used in wired money transfers to identify the source and destination of the money. As much as the two codes are used for money transfers, the major difference between them is that sort code is used for domestic transfers while swift code is used for international transfers. Here, we’ll explain everything you need to know about Zenith Bank swift and sort codes, what they are used for, and how you can get and use them to transfer money.

Differences Between Swift And Sort Codes

The 3 major differences between swift and sort codes are:

- Sort code is what you use while carrying out domestic transfers but for international transfers, swift code is what you need

- Sort codes are only numeric while swift codes are a mix of numbers and letters

- Sort codes are 6 digit number while swift codes contain 11 characters

Swift Code

A swift (Society for Worldwide Interbank Financial Telecommunications) code is used to identify the country, bank, and branch that a bank account is registered to. The code is unique and differs from one bank to the other, i.e no two banks have the same swift code. Whenever you send money to a bank account in another country through WorldRemit, your swift code will unfailingly be required by your bank to ensure that the money you are sending will get to the right destination (account). A swift code can also be called BIC (Bank Identification Code). A standard swift/BIC Code will contain Bank Code, Location Code, Country Code, and optional Branch Code.

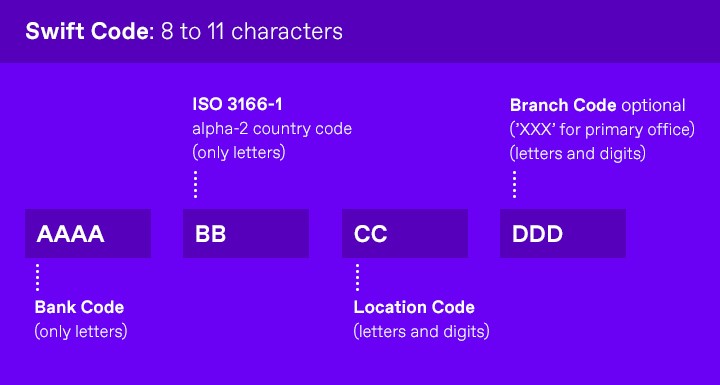

Swift Codes are 8 or 11 characters long and contain both letters and numbers.

- The first four characters specify the bank codes and only letters can be used.

- The next two characters are only letters that describe or give the country code.

- The next two characters can be a mix of numbers and letters that are used for location-based codes.

- The last three characters can be digits or letters and they are optional. These characters are used to give details about the branch code and can be omitted if the transfer is for the primary office.

Sort Code

Sort code is a six-digit code that was originally used for electronic transfers by the United Kingdom and Ireland. But today, sort code has been introduced in Nigerian banks and other countries as well, making electronic money transfers to be easier only within the country. Using a bank sort code, you can tell which bank has a particular account, the location of the bank, as well as the branch where the account is held. The code is used when transferring money from a bank account to another branch of the same bank or another bank entirely. It is also very essential when you are receiving money from an account in another bank.

How To Get a Zenith Bank Swift Code

Zenith bank keeps the swift code in several places, here are the likely places you can find it.

- Bank statement: This is a summary of all the transactions you make, using a particular account within a specific period. All your account details are available in it, including the swift code.

- Website or mobile banking app: Login to the website and go to the search box and type in ”swift code”.

- Zenith bank cheque: Open your checkbook and look for 3 pairs of a number, the first pair is your cheque number, the second is the bank sort code, while the third is your account number.

- Above all, you can get your swift code from any local branch of Zenith bank. When you get to the bank, go to the customer care section, inquire about your swift code and it will be given to you.

Procedure For Online Transfer From Zenith Bank To Overseas Account Using The Swift Code

From the definition and explanation given above, one can easily conclude that it’s not possible to send money from a Zenith Bank account to an account overseas without swift code. As simple as it gets, without swift code, your bank would not be able to identify the particular bank/destination the money is going to. Below are easy steps to follow when you want to send money from your Zenith Bank account to another country.

- First of all, you need to get the recipient’s swift code, account name, address, account number, bank name, and bank address.

- Before you can do an international money transfer you need to have a registered account set up by your bank (if you do not have one, you have to register before you continue). Use your username and password to log in to your Zenith Bank online banking app.

- After you opened your profile, search for the international wire transfer section at the top toolbar of the website and click on it.

- Specify the transfer limit, i.e the amount you want to transfer. Usually, if the amount exceeds $5,000, you will need to contact your bank for verification and permission. Your bank would send a confirmation code to your phone with a link through which you will continue your transfer.

- At this point, you will enter the recipient’s information. Ensure to type them correctly and not make mistakes.

- The next stage is to specify the currency in which you want the money to be paid. Even though the recipient’s currency will automatically appear the time you entered the bank details, you can still use the drop-down menu to change it to another currency of your choice. However, banks always encourage people to use the recipient’s currency. You can send the money in US Dollars in case you are not certain about the recipient’s currency.

- After you have specified the currency, the next step is to pay a transfer fee. While some banks charge $45 to $50, zenith bank charges a low fee of $40.

- Remember to check how long it will take for the transfer to be successful. Zenith bank usually estimates one to two working days to get the money to its destination account. While you wait, you can periodically check the status of the transfer by logging into the bank app and looking up the international wire transfer section.

What Happens If You Use the Wrong Swift Code?

If you mistakenly used the wrong swift code to send money to someone overseas, don’t panic because you are still much on the safer side. Given that you entered the correct account number and account name, rather than getting to the supposed destination (account), the receiving bank will simply revert the money to your bank account. The money will likely take 24 to 48 hours to bounce back to your account.

On some occasions, the money will not even leave your account at all as the bank will immediately detect that the swift code is incorrect and send you a notification. However, it is safer to cross-check the information you entered before you do your final click.

Is It Possible To Transfer Money From Zenith Bank to Overseas or Within The Country Without The Swift and Sort Codes?

As earlier said, without the swift code, Zenith bank cannot identify the exact bank or account the money should go to, especially when it’s an overseas account. Hence, the transfer will not be possible. So, the person you want to send money to will compulsorily make available his/her bank swift code before you can proceed with the transfer.

However, with the recipient’s bank name, account name, and account number, you can send money to any bank within the country without the swift or sort codes. The code only helps and facilitates transfer but not always essential for transfers within the country.