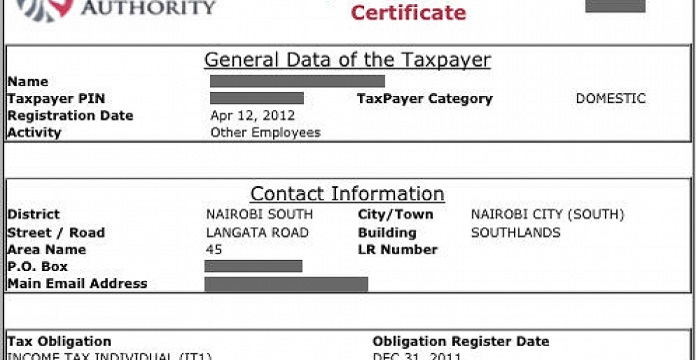

If you live in Kenya as an expatriate or citizen, one of the most important documents you will need is your KRA (Kenya Revenue Authority) Pin Certificate. With your KRA Pin Certificate, you can carry out several transactions and access the KRA iTax portal directly with no restrictions.

The Kenya Revenue Authority is the government agency responsible for the reception, calculation, and auditing of all revenues due to the Kenyan government. The government established the iTax system to collate taxes from all three forms of income in Kenya: business income, rental income, and income-employment income.

In other words, it is a necessary part of being a good citizen. However, while registering and applying for your KRA pin should be straightforward, it is something a lot of Kenyans and foreigners in Kenya continue to struggle with. This article will enlighten you on the procedures involved in applying, the requirements for different sets of people, and how to download your KRA Pin certificate.

Processes Involved in Applying and Registering for Your KRA PIN Certificate

Applying for and getting your KRA Pin certificate is an essential process that should be done as soon as possible. Under different Kenya Acts, the tax obligation mandates businesses and individuals to register and apply for a KRA Pin under the KRA iTax portal.

The process entails identifying the documents required for the kind of registration you are doing. There are different requirements for different individuals and businesses. Once you have determined and gathered the necessary documents, the next step is completing your registration online via the iTax portal.

For residents, they receive their KRA Pin certificate immediately after completing the online registration form. Non-residents, on the other hand, receive an acknowledgment receipt. They have to present the printed receipt at KRA headquarters alongside other documents to finish their registration.

Step by Step Procedure for Getting Your KRA Pin Certificate

The online application procedure for getting your KRA Pin is not complicated nor difficult as long as you follow the right steps and fill in the correct information as requested. Again, it is vital to have the proper documents for your registration process. We will discuss the requirements for different businesses and individuals further in the article. To get your KRA Pin Certificate, follow the eight steps below:

- Access the iTax portal by visiting the URL https://itax.kra.go.ke or doing a Google search of the term ‘iTax KRA.’

- Once the page loads, select the ‘new pin registration’ link on the right column if you are an unregistered user looking to register your pin.

- When you click this, the KRA Pin application form will be accessible to you. Proceed to select the taxpayer group you belong to in the drop-down field provided. The available options are Individual, which is for personal, entrepreneurs, employees, and students, and Non-Individuals for businesses and companies. You will also have to select the type of registration, be it online or upload form.

- This step involves filling in your basic information. Enter the accurate details as requested, and do not lie. Click on ‘next’ to proceed to the next section.

- The next step is to meet your taxpayer obligation requirements. Previously, all people had to do was tick a box. Improvement has been made by KRA, though. Now, you must include the registration date of the tax obligation you selected. The option for the tax obligations are Income-tax, Value Added Tax (VAT), and Pay as You Earn (PAYE) tax. The last option applies to employers only.

- Another new requirement is for all new users to mention their income source. The options are rental income, business income, and employment income. You have to choose one of the three.

- The penultimate step involves you inputting the details of the tax agent that helped with your application. This only applies if you made use of a tax agent. Once you have filled every field, you can proceed to submit.

- The final step comes after your submission. If it is successful, you will get a message notifying you it is successful. Your new pin will be displayed on the screen with a link that tells you to download your Pin certificate. You can proceed to download and print your KRA Pin certificate.

The KRA Pin Application Process is not Free of Charge

KRA Pin application has a default cost of Ksh 200 only. It is a one-time payment payable with the help of the cyber.co.ke M-Pesa Till number 745508.

Various Requirements for Getting Your KRA Pin Depending on Various Factors

There is no uniform requirement for applying for and getting your KRA Pin. The requirements for individuals differ from non-individuals. Even within non-individuals, a company’s requirements are not quite the same as those for a partnership firm.

Therefore, it is essential to know the documents required before deciding to apply for your KRA Pin. Take a look at the requirements for different categories below.

Requirements for a Company

- A copy of the certificate of incorporation

- A copy of the acknowledgment receipt

- PIN certificate for at least one of the company’s directors

- The tax compliance certificate for at least one of the company’s directors

- A copy of a document listing all the shareholders or directors of the company

- Memorandum copy and Article of Association (this is not compulsory).

Requirements for a Partnership Firm

- Deed of the partnership (Optional document)

- Tax certificate of compliance for the partners (optional document)

- PIN certificate for one of the directors

- Copy of the acknowledgment receipt

Residents

- National ID card or alien card details

- Registration certificate for the business (for entrepreneurs)

- PIN details of employers’ for those who are employed

Non-Kenyan Employee (Residing in Kenya) different from a Refugee

- An introductory letter by their employer

- KRA PIN application acknowledgment receipt

- Valid passport of the applicant

- Resident permit of the applicant

- PIN of employer

- Valid tax compliance certificate for employer or representative

Non-Resident Employee or Professional in Kenya for not more than Three Months

- An introductory letter by employer

- KRA PIN application acknowledgment receipt

- Valid passport of the applicant

- Valid special pass for the applicant

- Employers PIN

- Tax compliance certificate of employer or representative

Employees of Organizations under the Immunities and Privileges Act Cap 179, e.g., the United Nations

- Original passport and valid identity card for officials of UN agencies

- An endorsement letter by the Ministry of Foreign Affairs to the KRA

- KRA PIN application acknowledgment receipt

Employees of Institutions related to Organizations under the Immunities and Privileges Act Cap 179, e.g., IFC

- Letter of introduction by the employer and their PIN

- Original passport of the applicant

- KRA PIN application acknowledgment receipt

- An endorsement letter by the Ministry of Finance

- Identity card of officials of international organizations

Diplomats (Resident in Kenya)

- Original passport and diplomatic card

- KRA PIN application acknowledgment receipt

- An endorsed copy of original passport and diplomatic card by Ministry of Foreign Affairs

- Copy of exemption stamp on the passport

Non-Resident Married to a Kenyan Citizen

- KRA PIN application acknowledgment receipt

- Original valid passport

- Original and copy of marriage certificate

- Original and copy of ID card of Kenyan citizen with their PIN

- Dependent’s pass from immigration

Non-Citizen Students or Interns

- KRA PIN application acknowledgment receipt

- Original and copy of valid student pass

- Original and copy of valid passport

- Original and copy of a letter of introduction/ admission from the academic institution

British Army Personnel

- Original passport of the applicant

- KRA PIN application acknowledgment receipt

- Copy of the memorandum of understanding between the British and Kenyan Governments

- An introductory letter by the British Peace Support team in Kenya

Refugee Residing in Kenya – Employed or in Business

- Original and copy of valid refugee ID (validity is five years)

- KRA PIN application acknowledgment receipt

- Work permit from the immigration

- Letter from the employer if employed

- Business registration certification (for business owners)

- Letter of introduction from the Department of Refugees Affairs secretariat

The Reason Why You Should Apply and Register for Your KRA Pin

Some individuals or businesses might be wondering why they have to go through the hassle of sourcing and gathering documents to register for a KRA Pin and what the whole fuss is about. Asides from being mandated by numerous Kenyan Acts, there are some benefits attached to applying for a KRA Pin for yourself or your business.

First of all, who should have a KRA Pin? Based on the tax obligation option available to you, you should apply for a KRA Pin if you fall under any of the following categories:

- Business owner

- Employee

- Wish to perform certain transactions found in the lists below

- A beneficiary of rental income

- Seeking to apply for a HELB Loan

Now, the major reasons why you need a KRA Pin are:

- To file for and pay your taxes, you are required to have a KRA Pin

- The Kenyan law demands that you have a KRA Pin before you can carry out some transactions. The most popular transactions for which you need a KRA pin are:

- Registration of title and paying of land rent

- Deposit payments for power connection at Kenya Power and Lighting Company

- Registering motor vehicle and licensing under the Traffic Act

- Registering business names and companies by the business names and companies registrars.

- Applying for the Value Added Tax registration

- Importation of goods and Customs clearing and forwarding