With over 10 million customers, Equity Bank Kenya remains the preferred financial institution for Kenyan citizens. Since its incorporation in 2014, it has been able to satisfy the diverse needs of its customers while greatly improving on existing banking services in the country as a whole. In a bid to more efficient and effective banking services, Equity bank has employed several methods, one of which is leveraging on the ‘M-pesa’ platform to make international and local money transfers easy for her customer. To successfully do a transfer between Equity Bank Kenya and M-pesa one would need the “Equity Bank Paybill Number”.

What Makes The Equity Bank Paybill Number Unique?

The Paybill number is unique because it offers users an easier means of transaction than several other payment mechanisms like the Till Number which is a service that is also used for the purchase of goods and services from a merchant. The paybill number allows the customer to pay for goods and services using the M-pesa platform without necessarily being at the point of sale. In all, using the paybill number makes the process of doing transactions or payments less stressful.

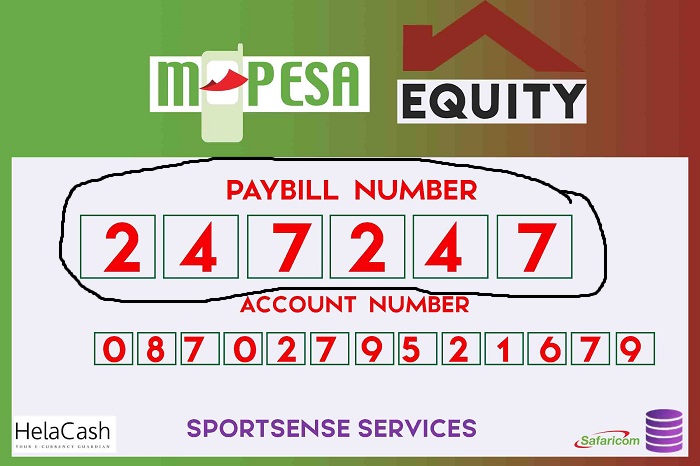

Because Equity Bank is notable for referring to their mobile banking service as ‘Eazzy 247’ it’s a no-brainer to introduce an equity paybill number to further simplify transactions for its customers. The unique Paybill number for Equity bank Mpesa transactions is ‘247247’.

Among the many good reasons Equity bank adopted the Paybill number is that it facilitates collecting money from user/customers at different times using M-Pesa. It does not require the customer’s presence for payments to be made. The pay bill is hereby the best option that can be used for e-commerce and remote services.

However, it is worth noting that the Paybill number allows customers to make transactions with organizations that they have an official relationship with. These transactions usually go through a specific account. This is to help in the easy identification of the customer or the user of the Paybill number. This means that to successfully use the Equity bank paybill number, you must have an account with the bank.

How Can I Deposit Money Into An Equity Account Using M-Pesa?

Doing a transfer from M-pesa whenever you want to make a deposit t your Equity bank account is one of the easiest ways to send money. So, whether you are at home or at work, you can now transfer money from your M-pesa account to an Equity Bank account. To get started, follow the steps below:

- Open the Safaricom SIM Tool kit on your phone and select the M-PESA menu

- Choose Lipa na M-Pesa, then select Paybill

- When you are asked for the Paybill number, input 247247 (for Equity Bank)

- Go on to Input your account number or the account number where you want to transfer the money to

- A prompt will appear asking for the amount you want to transfer, enter the desired amount

- Input your M-Pesa pin next

- Once you have provided all the information, cross-check all the details to make sure that the details are correct

- Press OK and wait for a response

- As soon as your transaction is successful, M-pesa and Equity Bank will send you confirmation messages with respect to your transaction.

NOTE: Using the Equity Bank Paybill M-Pesa will help save you the stress of having to queue up at the bank and in turn, save you time. There is also no need to fret about how much it will cost to perform this transaction as the transfer charge/fee for Equity bank Paybill M-pesa is quite low.

Why Is The Paybill Needed To Make Money Transfers?

Making financial transactions usually come with some risks and might result in losses. The Paybill number hereby serves as a form of security against these risks as it makes it safer and easier to deposit money into an Equity bank account safely.

The Paybill number is also a reliable means which M-pesa can use to pinpoint which of her affiliates a particular transfer is meant to go to. This means that using the Equity bank Paybill number, ‘247247’ will enable transfers to be sent with ease to the bank.

Is SWIFT Code Necessary In Transactions?

Another means made available to make banking easier and more effective is the use of the SWIFT code. It is one of the most credible ways of ensuring that international transactions between banks are done securely.

More so, the code can be used for directory purposes as it provides the necessary information about the bank, and the branch the money is going to. The SWIFT code hereby helps minimize possible mistakes that can be made when making international bank transactions.

This code usually has 8 or 11 characters which are used to identify the parties in a transaction. The first four characters in the SWIFT code represent the bank codes, the next two represent the country code which is followed by the two characters that represent the location, and finally, the last 3 characters are the branch codes.

How Do I Get The Equity Bank Swift Code?

If you already have an account with Equity bank it is quite easy to get their SWIFT code. All you need to do is to walk into the closest Equity Bank branch and ask any of the employees at the customer care section.

You can also get the code from the comfort of your home or wherever you are by searching for it online. The SWIFT code for Equity bank Kenya is usually given as EQBLKENAXXX – with XXX representing the branch code that you will input for the specific Equity branch you are using.

Do All Types of Transfers Need A SWIFT Code?

The Equity bank SWIFT code is used mainly for international bank transactions, that is, money transfers that are made to banks in countries outside Kenya. However, for local transactions, SWIFT codes are not necessary as there are several other ways to track domestic money transfers and in most cases, all that might be needed is the bank account number.