Life is full of uncertainties and part of them are unforeseen circumstances that require extra cash to sort them. Because they are unplanned, most people have to resort to borrowing in order to do the needful promptly. For so long, Kenyans relied on banks for loans in spite of their outrageous terms and conditions until some online loan platforms like Branch came to the rescue.

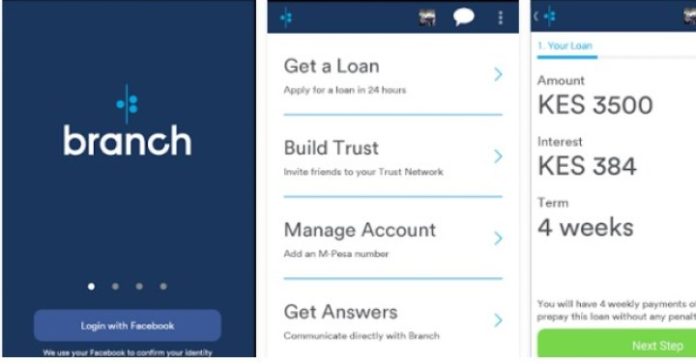

With the Branch loan platform, Kenyans can access a loan, anytime, anywhere without having to spend endless time in the banking halls signing loads of documents, worrying about collateral, or the high-interest rates. Here is everything you need to know about the Branch loan platform and how you get loans in a matter of minutes.

What Is Branch?

Branch is a microfinance lending institution that is an arm of Branch International. The financial institution currently operates in Kenya, India, Tanzania, and Nigeria. They have offices in these countries, as well as in San Francisco. Branch loans are designed to help people with little to no credit history or savings get loans without all the hassles involved in taking a loan from traditional financial institutions.

How Does Branch Loan Work?

To access a loan on the Branch App, all you need to do is to download the app and sign up. The app requests your permission to access your mobile phone, which includes your handset details, text messages, data, contact lists, Mpesa activities, etc. It is with this information that the app creates your credit score, which determines the loan offers you receive and determines your eligibility to access a loan.

Basic Terms And Conditions You Should Know Before Taking A Branch Loan

Before taking any loan, no matter how little or big, it is important to read through and understand the terms and conditions that apply to be properly guided. Before taking a Branch loan take note of these basic terms:

- Branch will be having access to every data on your mobile phone, including your handset details and financial transaction messages, etc, this is to enable them to make lending decisions. So, by signing up and requesting a loan, you have granted them this right

- For a first-time borrower, the highest loan limit is Kshs. 1,000

- Those living in Kenya can take a maximum loan of Ksh 100,000 and a minimum of Kshs 250 over a period of 4 – 52 Weeks. The interest charge ranges from 17% to 35%, depending on the loan option and an Equivalent Monthly Interest: 1.7% – 17.6% and Equivalent APR: 22% – 229%

- The app doesn’t ask for collateral and has no hidden charges for late payment/rollover fees, however, you lose your credibility for accessing further loans and you can get reported to the Credit Reference Bureau (CRB) if you don’t clear your debt

- Borrowers are to cover any mobile money transaction fees, such as M-PESA charges, associated with repaying the loan. Standard SMS and data charges by your mobile carrier may apply

What Are The Requirements For Applying For A Branch Loan?

The requirements to access a loan from Branch differ from country to country. In Kenya, you will need to have the following:

- An internet-enabled Smartphone

- A Safaricom line that is registered with Mpesa/Facebook account

- National ID number

The Branch app needs that information to verify that your account and sim belong to you, and no one else can apply for a loan using your account. So, armed with this information, you can go ahead and sign up on the Branch Loan platform.

Step By Step Guide On How To Download The Branch Loan App

Before applying for a Branch loan, you will need to download the Branch loan app from the Google Play Store, and below is the step by step guide on how to do that:

- Ensure that your smartphone is internet enabled.

- Go to the Google Play Store or iOS App Store on your phone and on the search space type “Branch loan app”, once it pops up, click on the install button and it automatically installs on your phone.

- After it has been installed, open the app and select your language preference and click continue. Click on the sign-up button and then on the “I’m new to Branch” button to proceed.

- Select your country and register with either your phone number or Facebook account. Whichever option you choose will take you to where you will proceed to fill out the details in the application which includes your name (ensure it’s the same name on your ID and Sim), gender, ID number, and date of birth.

- Once you are done with filling out the form, click on submit and wait for your account to be validated and once it is, you can proceed to apply for your first loan.

Applying For Your First Loan On The Branch App

- Once your account has been approved, you can go ahead and apply for a loan by following these steps:

- Still signed in, click on the loan button, then select the amount you want to borrow. Grant the app the permission to access your mobile phone, which includes your handset details, text messages, data, contact lists, Mpesa activities, etc. It is with this information that the app determines the amount of loan you are eligible for at any point in time.

- Wait for a text message informing you about your branch loan application status. If approved, the money is sent into your Mpesa account.

- All loans are processed within 24 hours. On average, loans are processed in less than 3 hours, thus, all things being equal, you should have your loan in your account within 3 hours of the request.

How Much Can I Get From Branch Loan?

If you are a Kenyan resident, the Branch loan app allows you to take a minimum of Kshs 250 and a maximum of Kshs 100,000 over a period of 4 to 52 weeks with an interest rate that ranges from 17% – 35%, Equivalent Monthly Interest: 1.7% – 17.6% and Equivalent APR: 22% – 229%

Interest rates are determined by a number of factors, including repayment history with Branch, etc. You can’t increase your loan limit by yourself, the app increases your loan limit when you repay loans earlier than the scheduled date. Another factor that helps in increasing your loan limit is requesting loans occasionally. This increases your digital footprint in their system.

For a first-time borrower, the highest loan limit is Kshs. 1,000.

Repaying Your Branch Loan

Branch has made it easy for customers to repay their loans without hassles. This can be done in 2 ways; you can either repay your loan via Mpesa or Branch App.

Through The Branch App

- Once you are signed in, go to ‘My Loan’, tap the round ‘Tap to Pay’ button.

- Select the amount you wish to repay. You can choose to pay the

- Next Amount Due

- Total Balance

- Other Amount (you will be required to fill the amount you want to pay) and your preferred method of payment – bank or debit card

- After you have made the selection, tap on ‘Continue’ and add your debit (ATM) card number (16 or 19-digit in front of your card), card expiry date (month and year in which your card expires), and CVV (the 3-digit number behind your card)

- After you have filled in the details, tap on the ‘Continue’, button and choose the auto-debit setting under ‘Payment Options’ and tap ‘Continue’.

To secure your payment, some banks will ask for your pin or send a security code to your phone, enter them appropriately and your payment is done. If successful, your account will be updated automatically within a few seconds and you will receive a debit alert to that effect.

Repaying Your Loan Via Mpesa

Repaying a loan via Mpesa is as simple as following these steps:

- Open the Mpesa Menu on your phone.

- Choose the Lipa na Mpesa option.

- Click pay bill. Once you click on the pay bill option, you will be requested to enter the pay bill number and the pay bill number for the Branch loan is 998608. Enter the number, followed by the account number. Note that the account number here refers to the mobile number you used in registering on the Branch app.

- Enter the amount you wish to repay, followed by your Mpesa pin, and then authorize the transaction.

- Wait for a message from Mpesa confirming the transaction and that is it, you have made your payment.

How To Contact Branch Loan In Kenya

At the moment, the Branch does not provide customer support by phone number or physical in Kenya. In case of any issue or complaint, you can send them a message via the app at any time, and they will help you resolve whatever issue you may have or send them an email at [email protected]

They can also be reached via their social media handles

On Facebook at @branchkenya

On Instagram at branch_co

On Twitter at @branch_co / Twitter

FAQs About Branch Loan App

- What does the app mean by SIM unsupported?

If you get this kind of message, just know that the Branch app was unable to detect the required SIM on your phone. To resolve this, kindly remove all the other SIM cards on the phone and leave only the Safaricom SIM you want to use, and then log back into the Branch App. Once this is done, enter your number and proceed to validate it.

- Can I change my identification number after I receive a loan?

At Branch, data integrity is of utmost importance, thus, you cannot change whatever information you previously used to process a successful loan application.

- Can I delete my account?

Yes, you can but please ensure that you have repaid all of your loans before you do so and then write to Branch on the in-app chat with your request.

- Why was my loan application rejected?

If you met all the requirements to access a loan then don’t worry! Sometimes it may take several attempts to qualify for a loan. You are encouraged to continue saving data on your phone and to reapply after the period stipulated.

- Can I apply for a higher amount than shown?

No, you can’t. The fastest way to increase the amount you are eligible for is to build credit by making each repayment as scheduled.

- Is there a monthly repayment option?

Yes, there is, however, it is dependent on the loan amount you selected. To access the monthly repayment option, tap “Select Loan Terms” to choose between weekly or monthly payments prior to requesting the loan. If you choose weekly repayments, you will need to pay each installment by its weekly due date in order for your loan to be considered on time.

- Can I repay my loan earlier than scheduled?

Sure you can, this actually increases the amount you are eligible for, so it is strongly advised to repay your loan according to your “Repayment Schedule”, which can be found by tapping the “Loans” option at the bottom of the Home screen.

- Will my loan size increase every time I repay?

Your loan offers are automatically determined by a number of factors. Even though it may not always increase immediately, it will increase over time as you continue to make all of your repayments as scheduled.

- Can I repay with one payment at the end of the loan term?

You are strongly advised to make your repayments as they appear on the “My Loan” page. Skipping your other repayments and paying the loan on the last due date will negatively affect your future loan amounts.

- What happens if I overpay my loan?

If you overpay your loan on your last repayment, the amount will remain on your account and be applied on the repayment of your next loan so no need to worry about that.

- What will happen if I miss my repayment?

Paying each installment as and when due allows you to access larger loan sizes. Late repayments will affect your ability to get subsequent or larger loans and if you are very late on your payments, you will be reported to the Credit Reference Bureau (CRB) and will be blacklisted by the CRB which may affect your ability to borrow from other lenders.