Opening an account with Access Bank involves a very simple process that requires a prospective customer to visit any of the bank’s branches. However, with recent technological advancements, customers can now open accounts from the comfort of their homes and offices.

Accounts in Access Bank fall under different categories; there is the savings account that attracts minimal opening requirements, current accounts, and company accounts. Apart from these, the bank also offers several other types of accounts tailored towards the needs of salary earners, schools and institutions of higher learning, clubs, and associations.

Opening requirements for all the categories of accounts differ, as well as their features and benefits to customers. Access Bank also offers its customers an opportunity to upgrade their accounts from those with restricted transactional activities to the ones that can be operated without limit. All the customer needs to do is provide all the required documents and his account upgrade will be accomplished in less than 20 minutes.

The Available Alternative Channels To Open An Access Bank Account

Apart from visiting the bank’s branches which is the age-old method of opening a bank account, customers of Access Bank can now go through alternative channels to get their bank accounts opened and running. They include:

- Contact Center

- Bank’s official website – https://www.accessbankplc.com

- Account opening can also be done online through Access Bank’s Internet Banking platform.

- Or customers can dial the latest *901*0# on their mobile device, then follow the ensuing prompts to open an instant account.

Can An Access Bank Account Be Opened Without BVN?

Usually, BVN is among the necessary requirements to open an account with Access Bank. However, there is still a window for customers who don’t have Bank Verification Numbers to enjoy financial inclusion with the bank. You only need to provide:

- Mobile phone number.

- National ID

- Email address

- Full name

- Address

Take These Steps To Open An Account Without Bank Verification Number In Access Bank

- On your phone, dial *901#

- Select open “1” to get your account opened

- As the instructions pop up on your screen, populate the provided fields with the right information.

- Check all the provided information to ensure that they are correct and accurate before sending

- Once the process is complete, the bank will send an instant SMS with your account number, including any other relevant details.

Access Bank Account Opening Process

The process of opening an account is almost the same with all commercial banks. In the case of Access Bank, it is an easy and straightforward process. Once a customer has decided to domicile his or her account with Access Bank, the person should do the following;

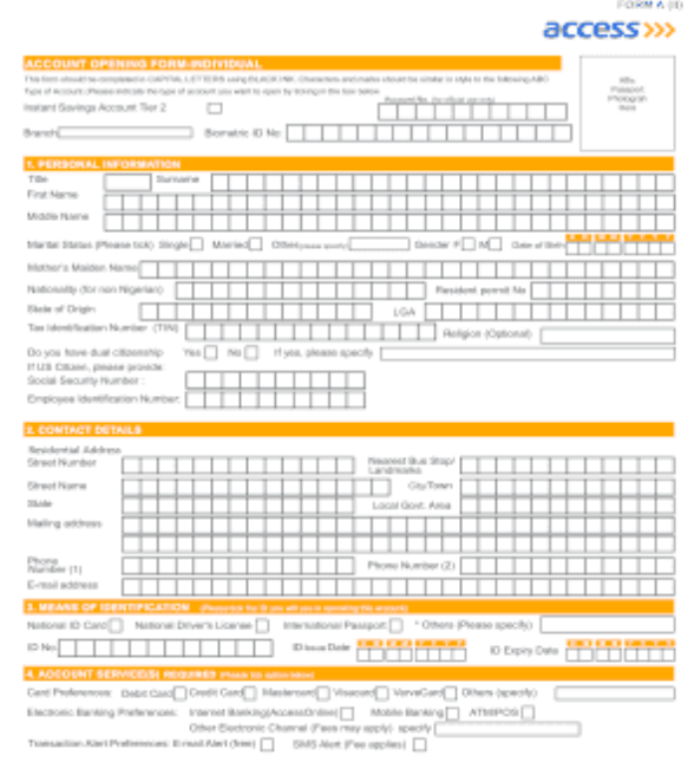

- Decide on the type of account you want and meet the bank’s customer service person who provides you with an account opening form.

- Fill your account opening form with the required information. This includes all relevant details regarding the customer’s name, address, phone number, email, occupation, and all other required details. Once you are satisfied with the form, go ahead and endorse the provided specimen signature card.

- Some accounts require referees. If yours falls into this category, you have to collect reference forms to be filled up by account holders either in Access bank or other banks.

- Other documentations like means of ID passport photo, proof of residence, etc also need to be provided. Company account must provide all the Certified True Copies of documents used in registering their company.

- Once the account opening package is completed, you have to go back to the banking hall to submit it to the customer service person.

- The customer service person goes through your account opening package to ensure that all required documentation is in order. The officers also go through the account opening form to make sure that all required information was provided.

- Once the customer service person is satisfied, he or she will assign an account number to the customer.

- The customer then makes an initial deposit into the account depending on the stipulated amount for different types of accounts.

- Once the account is opened, the bank issues the customer with a debit card, cheque book (in the case of current accounts and the likes), and enables alternative channels like mobile banking and internet banking.

- With this done, the customer can sit back and operate the account from the comfort of his home and office, leveraging the alternative banking channels.

Types of Access Bank Savings Accounts

1. Instant Savings Account

As the name suggests, Access Bank Instant Savings Account is the type of account that can be opened instantly with just one passport photo. This type of account comes in two variances; Instant Savings 1 and Instant Savings 2.

Features

| S/N | Instant Savings 1 | Instant Savings 2 |

| 1. | Zero opening balance | Zero opening balance |

| 2. | Uploading of account details can be done via branch, contact center, or website | Uploading of account details can be done via branch, contact center, or website |

| 3. | Attracts only Verve card | Attracts only Verve card |

| 4. | 1.15% p.a. interest rate | 1.15% p.a. interest rate |

| 5. | A maximum single deposit of N50,000 | A maximum single deposit of N100,000 |

| 6. | Maximum cumulative balance of N300,000 | Maximum cumulative balance of N500,000 |

| 7. | The account can only be operated within Nigeria | Transactions are limited within Nigeria |

Benefits

- Account opening requirements are convenient and flexible

- Account opening can be done via the bank’s branches, website, or contact center

- Makes financial inclusion possible for account holders who lack the full account opening requirements

- The account does not attract monthly maintenance charges

- Keeps the account holder updated via Email and SMS alerts

- Issuance of debit cards for easy access to cash anywhere and anytime.

- The Verve debit cards can be used on POS terminals

Requirements

| S/N | Instant Savings 1 | Instant Savings 2 |

| 1. | Account opening form duly completed and signed | Account opening form duly completed and signed |

| 2. | 1 passport photo | 1 passport photo |

| 3. | Means of identification is not part of the requirements | Any verifiable means of identification (secondary Id) such as student Id or association Id can suffice |

| 4. |

|

|

| 5. | Data verification is not required for customer | Customer data verification should be done with INEC, NIMC, FRSC, and other |

2. Premier Savings Account

Access Bank Premier Savings Account is an account that assists customers to save towards their financial security and achieve peace of mind. What’s more, there will always be easy access to your funds 24/7 no matter your location.

Features

- N1,000 minimum opening balance

- Zero minimum daily balance

- 1.15% p.a. interest rate paid on a monthly basis

- A debit card is accessible in several variances and issued based on the preference of the customer.

- Use of alternative banking channels such as mobile banking and internet banking.

- Permits dividend warrants deposit up to ₦10,000 (for a/c payee only)

- Up to ₦2,000,000 cheque deposit is allowed

- Charges for other transactions are done in accordance with the Banker’s tariff

- Customers who have active cards are charged N50 for monthly maintenance fee

Benefits

- Account opening requirements are convenient and flexible

- Deposit of dividend warrants

- The bank’s channel platforms give customers remote access to their account

- From the comfort of their homes and offices, customers can monitor the activities in their account via the internet, mobile banking app, and telephone

- Customer enjoys account information updates through SMS/Email alerts

- The account is completely devoid of monthly maintenance fees

Requirements

- Account opening form duly completed and signed

- One passport photo

- KYC Documentation

- Valid proof of customer’s residence

- Visitation report

- BVN of the signatory(ies)

- AML risk assessment

- Valid means of id e.g. National Identity Card, International Passport, Driver’s License, or Voter’s Card

- Foreigners are expected to provide a valid Residence Permit or Work Permit

3. Early Savers Account

Access Bank’s Early Savers Account is a special account targeted at the younger generation. Eligible to open this type of account are people from 18 years downwards, including unborn babies. The account is usually opened by a child’s parents who become signatories until the child attains the age of 18. Parents leverage this kind of account to instill financial literacy in children from an early age, nurturing them into accountable and responsible adults.

Features

- N1,000 minimum opening balance

- Zero minimum daily balance

- 1.15% p.a. interest rate

- Permits dividend warrants deposit up to ₦10,000 (for a/c payee only)

- Parents open the account and hold it in trust for the minor until he or she becomes an adult

- Permits direct debit instruction

Benefits

- Account-holders are exposed to the exclusive opportunities of attending the Access Early Savers events.

- The Early Savers Financial Literacy Club admits account holders as members

- Early Savers Microsite offers account holders unrestricted access via https://earlysavers.accessbankplc.com

- Early Savers Quarterly newsletter is given free of charge

- Any dividend warrant in the child’s name can be deposited, subject to a maximum amount of N10, 000

- Parents can access school fees advance for their children

- Ease of saving via standing order instructions

- Early Savers Account is both online and real-time.

Requirements

- Account opening form duly completed and endorsed

- KYC Documentations both for the child and parent

- Valid proof of residence

- Visitation report

- The guardian AML risk assessment

- 1 passport photo each for the child and parent/guardian

- Parent’s valid means of identification: any valid means of Identity, showing the same address quoted in the account opening form, will suffice for both as means of identification and address verification.

- Child’s birth certificate/International Passport

- Parent/Guardian’s BVN

4. Standard Savings Account

The Access Bank Standard Savings Account affords account holders the opportunity to conveniently and easily accumulate funds for the future. This account helps in encouraging a savings culture.

Features and Benefits

- Account details can be accessed via mobile app, internet banking, and alert facilities

- Permits direct debit instructions

- Easy to open as well as operate

- A debit card can be used on POS and ATMs

- Competitive interest rate

- Security for every type of loan

- Quarterly Compounded interest

- An International VISA card can be issued upon request

- Available in both local and the major foreign currencies

- Permits standing orders

Requirements

- A valid means of Id: National ID or International Passport (for foreigners)

- Address verification

- 1 passport photo

- Residence permit (for foreigners)

5. Access Advantage Account

The Access Advantage Account is one special saving account equipped with the trappings of a current account. A high interest-yielding account sporting unique features and remarkable benefits that provides its subscribers with world-class financial services.

Features and Benefits

- The requirements for account opening are convenient and flexible

- Offers customized cheque books that are tagged Not Valid for Clearing.

- Bonus Interest for the accounts showing quarterly average balances (This must fall within the qualifying bands).

- The accounts to qualify are those with less than three withdrawals in a quarter showing a quarterly balance of N250,000 on average.

- The convenience of withdrawing cash via ATMs.

- Zero charges on any withdrawals made from Access Bank ATM.

Types of Access Bank Current Accounts

1. Individual Current Account

This is the type of current account that can be opened and operated by individuals.

Features

- N10,000 opening balance

- It does not require any minimum operating balance

- Account maintenance fee is charged N1/mile

- Attracts a debit card (different variants) and the type to be issued is based on the customer’s preference

- Internet/mobile banking facilities

- Attracts cheque book

- Permits direct debit instructions

- Third-party transactions are enabled

- All other transactions attract charges (at the bank’s approved rate)

Benefits

- Qualified customers can enjoy access to loan and overdraft facilities at highly competitive rates.

- Remote access to your account

- Customers can conveniently monitor activities in their accounts from the comfort of their homes/offices through the phone, internet, and mobile banking.

- Third-party withdrawals

- Account opening requirements are convenient and flexible.

- Customers get constant updates on their accounts via Email/SMS alerts

- Debit cards, Automated Teller Machines, and Point of Sales terminals give you constant access to cash

Requirements

- Account opening form duly completed and signed

- Two reference forms

- Means of identification; National Identity Card, International Passport, Driver’s License, or Voter’s card

- KYC Documentation; this is done on the customer

- Valid proof of residence

- Visitation report

- BVN of signatory

- AML risk assessment

- One passport photo

- N10,000 opening deposit (cheque/cash)

2. Premium Current Account

Premium Current Account from Access Bank is a unique account, specially designed to expediently cater to the daily transactional needs of a wealthy client.

Features

- N1 per mille Account Maintenance Fee; this is negotiable

- Monthly maintenance of ₦1 million balance attracts free banking

- N25,000 minimum opening balance

- Minimum operating balance of N25,000

- No fixed monthly fee

- Credit balance does not attract interest

- Daily withdrawal limit of ₦200,000 on ATM

- Attracts debit card

- Attracts cheque book

- Customers can access Xclusive Lounges (this happens when they subscribe to XclusivePlus)

- e-Statement of Account are sent monthly at zero charges

24/7 Banking through the bank’s Online and Mobile banking platforms.

Requirements

- Account opening form duly completed

- Signature specimen card duly completed

- Two reference forms

- Two passport photos

- Valid identification like international passport, voters card, driver’s license, or national ID card. Your NIMC slip can suffice

- Resident permit (where applicable)

- Proof of address; recent utility bill, house rent receipt, DSTV receipt, e.t.c

- Holders of Premium Current Account are allowed to subscribe to the bank’s XclusivePlus lifestyle proposition to enjoy the exceptional services and special privileges they deserve.

Business Accounts Offered by Access Bank

Business accounts are those accounts that enable entrepreneurs to run their businesses effectively. In Acess Bank, this type of account comes in various types, including the one for foreign currency.

1. MPower Biz Account

This account is specially designed to take care of the needs of a businessman, enabling the person to run the account at negligible cost while he maximizes any other opportunity required to expand the business.

Product Features

- N50,000 account opening balance

- N100,000 as minimum daily balance

- Does not attract account maintenance fee.

- Maximum turnover of N100 million monthly

- Debit cards come in different variances and are issued based on a customer’s choice

- Alternate channels such as online, telephone, and mobile banking

- No restrictions placed on the number of withdrawals

- Direct debit instructions

- Does not attract current account maintenance fee (this is subject to a maximum turnover of N100 Million (monthly) and an N100,000 minimum daily balance

- Customers can access Platinum Credit Card

Benefits

- Online real-time account

- Does not attract current account maintenance fee (this is subject to maintaining the aforementioned minimum balance plus the maximum turnover covenant)

- Financial Advisory Services are offered free of charge

- Economic and Business Intelligence Reports are available for free

- Customers are at liberty to monitor their account activities from the comfort of their homes or offices leveraging the bank’s alternative channels like internet and mobile banking platforms

- Third-party withdrawals

- Customers get account information updates through SMS/Email alerts

Requirements

- Account opening package duly completed

- Evidence of address (like a utility bill)

- Two references

- Two passport photos

- Valid ID of each of the signatories

- Residence Permit (for foreigners)

- Forms CO2 and CO7

- Business Registration /Certificate of Incorporation

- Memorandum and Articles of Association

- Board resolution

- Search report

- BVN

2. Domiciliary Account

Access Bank Domiciliary Account allows holders to save, make, and receive payments in foreign currencies like Pounds, Dollars, Euros, Yen, etc. The account can be opened for companies as well as individuals. Customers who already have their current accounts and company accounts running in Access Bank do not need to submit additional requirements to open a Dom account. They may only write a letter to that effect. However, those who do not previously hold accounts in the bank can go ahead and provide all the required documentation.

Features and Benefits

- Opening balance of $100, £100 & €100 etc.

- The account is available to both individual and corporate customers

- Zero minimum daily balance

- Attracts customized cheque book

- Zero Monthly Maintenance

- No restriction is placed on the number of withdrawals

- 0.01% p.a. interest rate (above 100,000 GBP, Euro and USD)

Requirements

- Means of address verification like utility bills

- Two references

- Two Passport photos

- Valid means of Id per signatory

- Residence Permit (for foreigners)

- Forms CO2/CO7 as applicable

- Business Registration/Certificate of Incorporation

- Memorandum and Article of Association if applicable

- Board resolution if applicable

- Search report if applicable

3. Corporate Account

This type of business account can be opened by entrepreneurs whose businesses are registered under incorporated business entities with the Corporate Affairs Commission. Its services are designed to meet the daily needs of any company.

Product Features

- N50,000 account opening deposit

- Zero minimum balance

- Account maintenance fee – N/mille

- Attracts a Cheque book

- A debit card is offered in different variance and it is based on customer’s choice

- Alternate channels such as online, telephone, and mobile banking are available

- Permits direct debit instruction

- Third-party transactions are allowed

- Any other transaction will be charged at the banks approved rate

Benefits

- Qualified customers will be able to access loan/overdraft facilities at highly competitive rates

- Customers are at liberty to monitor their account activities from the comfort of their homes or offices leveraging the bank’s alternative channels like the internet, telephone, and mobile banking

- Permits third-party withdrawals

- Account opening requirements are flexible and convenient

- Account information updates constantly come through SMS/Email alerts

Requirements

- Duly completed account opening package

- Evidence of address

- Two references

- Two passport photographs

- Valid ID per signatory

- Residence Permit (for foreigners only)

- Forms CO2/CO7

- Business Registration/Certificate of Incorporation

- Memorandum/ Article of Association

- Board resolution

- Search report

- Power of attorney (where applicable)

- Partnership deed (where applicable)

- Letter of administration or Letter from the Bursar or from Dean or HOD (whichever is applicable)

- Resident Permit (for non-Nigerian)

- Tax Identification Number (TIN)

- BVN of the signatory(ies)

- Proof of appointment of a company secretary or Authorization from Accountant General or treasurer of LG council (whichever is applicable)

4. Gold Current Account

Access Bank Gold Current Account is designed to cater to the daily needs of a typical one-man business. It is cost-effective as well as transactional.

Features and Benefits

- N5,000 minimum account opening amount

- N5,000 minimum daily balance

- No restriction placed on the number of withdrawals

- Competitive Interest rate

- Access to alternative channels: Online/Mobile banking platforms

- Cheques: valid for clearing

- Account-holders can access financial planning tools free of charge

- No CAM; this is subject to compliance with the stipulated monthly turnover pegged at N5 million

- Any turnover that goes above the threshold attracts a CAM charge of N1 per mille; this is only applicable on the excess.

5. Partnership Account

This type of account is targeted at unincorporated business entities that are registered under partnership business. Ownership must be more than one person who has equal responsibility for liabilities, assets, profits, and losses.

Requirements

- Duly completed and signed Account Opening Form

- Form CO2

- Two Passport Photos per Signatory

- Certificate of Business Registration

- Valid means of Id per Signatory

- Memo and Article of Association cum Partnership Deed

- Two Reference Forms

- Board Resolution

- Proof of Residence such as Recent Utility Bill, Tenancy Agreement, water rate, etc.

- Search Report

- KYC Form

- Operating Instruction

- AML Assessment Form

- Mandate Card

- Visitation Report

- Form CO7

- Resident Permit (For foreigners)

6. Sole Prop Account

This account is targeted at small but registered business entities that are owned and operated by a single person. The account is characterized by low transaction volume.

Requirements

- Duly completed and signed Account Opening Form

- Certificate of Business Registration

- Identification of signatories

- Copy of Proprietor’s List

- Two passport photographs per signatory

- Two Reference Forms

- Resident permit (For foreigners)

- Mandate card

- Search report

- Address verification

- Indemnity or Letter of Set-Off

- Visitation report

- AML Assessment Form

- KYC Form

- Proof of residence recent utility bill, tenancy agreement, residence permit, telephone bills, etc

7. Mpower Salary Account

This is a customized salary account tailored to aid big corporate organizations in payroll administration. The staff of the company is the primary beneficiary as the account allows them to enjoy a unique banking experience.

Features and Benefits

- No Account Maintenance fee (lifetime)

- Permits direct debit instruction

- Third-party transactions permitted

- A debit card is issued free of charge (Accesslink)

- No charges on standing Instruction to any high interest-yielding/generating savings account (Goal Account)

- Account-holders can access Loan facilities like Salary Advance, Personal Loan, Vehicle Loan, etc)

- Customers can access Investment and Insurance Products

- Alternative banking platforms; Alerts, Internet Banking, Mobile Banking

- Account-holders can get access to discount packages; this can come from loyalty partners

Requirement

- One passport photo

- Valid national identity card

- Proof of residence like utility bill/visitation report

- One reference/Letter from the employer

- Residence/work permit (where applicable)

- Fully completed and signed account opening package

8. High-Interest Deposit Account

High-Interest Deposit Account (HIDA) is a special deposit account targeted at customers who wish to save for a particular project or keep funds away for a rainy day while they fully maximize credit interest earned on their savings. Account-holders can enjoy what is known as tiered interest rates. What this means is that larger balances attract more interest income. Interest is earned per annum and accrues every day on the available credit balance; it is payable monthly.The going interest rates are as follow

- Less than ₦100,000 attracts 0.5% p.a.

- ₦100,000 to ₦4,999,999 attracts 1.5% p.a.

- ₦5,000,000 to ₦99,999,999 attracts 3% p.a.

- ₦100,000,000 to ₦249,999,999 attracts 3.5% p.a.

- ₦250 million and above attracts 3.15% p.a.

Features

- With this account, customers enjoy the flexibility and convenience of depositing cash, cheques (other banks), and dividend warrants at Access Bank’s branches

- Four free withdrawals are allowed on the account without the fear of interest forfeiture

- Debit card is not issued on the account, thus, it encourages people to save

- Whenever the balance on the account goes below N5,000, it attracts N150 as a penalty charge

Requirements

- One passport photograph

- Personal Identification: Current National Passport, Driver’s License, National ID Card, Voters’ ID Card, NIMC (National Identity Management Commission) Card

- Resident Permit (for foreigners)

- Address verification: Utility bills like PHCN, NITEL, etc.

- N100,000 Minimum Opening Balance

Benefits

- Zero COT

- Internet banking

Other Types of Account

1. Joint Account

A joint account can either come as savings or current and operated by more than one person. It comes with a specified mandate requirement that dictates the extent to which each of the signatories can effect transactions.

Requirements

- Account Opening Form duly completed and signed

- Two Passport Photos per signatory

- Valid means of Id per signatory

- Two References

- Proof of Residence

- KYC Form

- AML Assessment Form

- Visitation Report

- Resident Permit (for foreigners)

- Mandate Card

- Operating Instruction

2. Unincorporated Clubs/Societies/Association Account

Registered non-profit making entities can open this type of account with a minimum of 2 signatories mandated to run it; this is in addition to the association’s specific constitutional requirements.

Requirements

- Account Opening Form duly completed and signed

- Mandate Cards

- Certificate of Registration (Certified True Copy)

- Operating Instruction

- Two Passport Photos per signatory

- Constitution of the association/society

- Resident Permit (for foreigners)

- Minutes of the meeting specifying where account should be domiciled

- Particulars of Trustees (If Applicable) (Certified True Copy)

- KYC Form

- AML Assessment Form

- Board of Trustees Resolution

- Visitation Report

- Two references

- Valid means of Id per signatory

- Proof of Residence

- Power of Attorney

- Search Report (If Registered)

3. Public Organization Account

This type of accounts is targeted at Government-owned entities with activities that are either commercial or otherwise.

Requirements

- Account Opening Form duly completed and signed

- AML Assessment Form

- Signature Cards

- Passport photos per signatories

- Valid means of Id per signatory

- Letter of Authorization; this should come from Accountant General or Executive Council Resolution/ Treasurer of LGA Council

- Copy of Enabling Act/decree cum Certificate of Incorporation (whichever is applicable)

- Memorandum and Article of Association

- Form C07

- Copy of Financial Regulation (if applicable)

- KYC Form

4. Estate Account

This type of account is opened and operated in the name of the estate of a dead person. Account opening is usually done by a representative of the estate referred to as the estate’s executor/administrator.

Requirements

- Account Opening Form duly completed and signed

- Mandate Cards

- 2 Passport Photo per Signatory

- Letter of Administration; this nominates the Next of Kin

- Copies of the deceased Death Certificate

- Visitation Report

- KYC Form

- All other requirements required to open an Individual Current Account

- AML Assessment Forms

5. Money Market Account

This is an internal account tailored to suit the needs of account holders & non-account holders who wish to invest in Access Bank’s money market products.

Requirements

- Account Opening Form

- Board Resolution (if Corporate)

- Two Passport Photos

- Form C02 (if Corporate)

- Valid means of Id

- Form C07 (If Corporate)

- Two Reference Letters

- Proof of Residence

- KYC Form

- AML Assessment Form

- Visitation Report

- Resident Permit (For foreigners)

- Mandate Card

- Search Report (If corporate)

6. Schools/Colleges/Tertiary Institutions Account

A type of corporate current account tailored to suit the needs of institutions of learning.

Requirements

The customer should bring along all documents required for the opening of a corporate account, in addition to the under-listed:

- Copy of the institution’s approval; this must emanate from the National University Commission or Relevant Government approval emanating from the Ministry Of Education

- Letter from the Bursar or Accounts Office

- Certificate of Incorporation (if applicable)

For departments in the institution of learning, the following are also required:

- A letter from the Head of the Department/Faculty

- Constitution of the Department

- Extract of the department’s minutes of the meeting where the banking relationship was stated.

7. Financial Institutions Account

This type of accounts can only be opened and operated by entities that are engaged in activities such as acceptance of deposits from the public, including other repayable funds. This includes the transfer of money or value, lending, financial leasing, etc.

Requirements

- Account Opening Form duly completed and signed

- Mandate Cards

- Two passport photographs per signatory

- Valid means of Id per signatory

- Form C02

- Form C07

- Certificate of Incorporation

- Memorandum & Article Of Association

- KYC form

- AML Assessment Form

- Visitation report

- Board Resolution

- Search report

- Operating Licence from Regulator

- Proof of Residence

How to Upgrade An Existing Access Bank Account

Account upgrade simply means moving an existing account to another plan with a greater usage limit. A good instance is when an account is upgraded from an Instant Savings Account (tier1 and tier2) to a Standard Savings Account (tier 3 savings account).

The tier 1 and tier 2 savings also known as Instant Savings 1 and 2 have a maximum cumulative balance of N300,000 and N500,000 respectively. But the Standard Savings Account can be operated without limit. To upgrade an account in Access Bank, a customer must be physically present at the banking hall as accounts are not upgraded online. Once in the banking hall, go through the following steps:

- Talk to the customer service official about upgrading your account

- The customer service will request documentation like a passport photo, utility bill, Bank Verification Number, and valid means of identification.

- If the aforementioned documentation is available, the customer will be issued an account upgrade form which should be filled with details like name, BVN, account number, phone number, and home address. Important to note that the home address to fill on the form should correspond with the one on the utility bill, otherwise, it will be rejected.

- A bank account upgrade letter will be issued to the customer where the person will indicate his or her interest, desire, and the reason for the account upgrade.

- Once you complete the forms and submit them, the customer service person will use them to upgrade your existing bank account to the tier you wish to operate.

- Account upgrade can be done on the spot once all the documentation is in order. All the processes from the filling of the upgrade form to submission and upgrading may take less than 20 minutes.

How To Block An Access Bank Account

With the recent technological advancements, it has become possible for account holders to block their accounts in the event that they suspect some fraudulent activities in their accounts or lose their ATM cards. Owing to emergency situations like that, Access Bank has released a USSD code called Access Bank Account Blocking Code through which customers can prevent funds from leaving their accounts.

The approved USSD code for the bank is *901*919# and it works on any kind of device. It does not require data to work and neither does the customer need to load airtime to use the code. The code can be dialed at any time of the day; morning, afternoon, or midnight and it does not matter whether it is a weekday, weekend, or public holiday.

The same code can also be used in blocking your ATM card. Also, customers can send an email to [email protected] to block their cards or they can decide to visit the bank’s official website to get the same result. The mobile app can also come in handy in emergency situations.

How The USSD Code Works

It is important to note that this can only work with the mobile phone number connected to the particular account you wish to block. Now, get the phone line and dial *901*919#. As soon as it is dialed, an automatic “post no debit” instruction is posted on your account. This process can take less than three minutes to complete and with the instruction, it will be impossible for anyone to withdraw funds from your account. Even the account holder is debarred from making withdrawals.

Also, customers should note that a “post no debit” instruction is never permanent, thus, there should be no fear about using the code in times of emergency. The instruction will only be effective as long as you want it to. When the account holder is ready to lift the PND, he or she will have to visit any branch of Access Bank where the customer service person will unblock the account with the person’s consent.

Calling To Block Your Access Bank Account

Customers who don’t have immediate access to the Access Bank Account Blocking USSD Code are not completely helpless in times of emergency. In the absence of the code, the bank has devised another effective way of blocking your account. Here, all you need do is place a call through to Access Bank Customer Care Service. The right number to dial is 012802500.

Once you call the line, outline your request immediately without mincing words and it is now left for the customer service rep to swing into action and block your account before any damage is done. Also, unblocking such an account means that the customer will have to visit any of the bank’s branches and talk to the customer service person.