In a bid to serve her customers better and keep up with the digital age with stiff competition from new age and tech-minded banks, UBA has set up self-service mobile banking channels to bring its services closer to her customers, no matter where they are. These UBA mobile banking channels can be used online and on mobile devices to access most of the traditional banking services customers would ordinarily walk into the bank to perform. Here’s a detailed explanation of how to use each of them.

UBA Mobile Banking Channels

Currently, you can have access to your UBA account remotely and either offline or online through any of these means;

- UBA USSD Code

- UBA Mobile Banking App

- UBA Web/Internet Banking

UBA USSD Code *919#

This channel is perhaps the easiest to use. This is because it can be done from any phone, it doesn’t matter if it’s internet-enabled or not. What the user needs to do is type the UBA Ussd code *919# using the same phone number he or she used to register an account with the bank and then follow the instructions to perform a wild range of banking transactions.

Requirements for Using UBA Magic Number

- Have an account with UBA

- Be a UBA Africard User

If you don’t have a UBA account, you can easily open one. Just dial the UBA USSD code and follow the instructions. You’ll be sent your account number on the same phone line you used. To fully enjoy the account though, you’d have to go to the bank for your BVN to be linked to your bank account.

How to Register and Use UBA USSD Code

The UBA USSD Code is also called the magic number and for obvious reasons, we agree. A lot of bank transactions can be carried out with this number. But first, you have to register to use it, which is easy. All you need to do is dial *919# and follow the prompt. There are actually two registration options, depending on the type of card or account you are using. If you are not registered, you’ll get the option to either register with a UBA Account or with UBA Prepaid Card. You can use either of them, depending on what you have, you can’t register both with the same profile.

UBA USSD Codes and What They Are Used For

- *919*12 – For Airline Tickets Payments

- *919*amount# – To buy airtime for self

- *919*phone number*amount# – to buy airtime for others

- *919*00# – Check account balance

- *919*5*2# – For DSTV and GOTV subscription payment.

- *919*8# – Generate OTP

- *919*10# – Block Debit Card

- *919*9# – Freeze Online Transactions

- *919*18# – Retrieve BVN

Benefits of Using UBA Magic Number *919#

- Transfer funds easily to both UBA and non-UBA customers

- Buy and send airtime and data to both yourself and third parties

- Pay for services such as flights, pay-TV subscriptions and utility bills

- Check your account balance

- Block your account in case of theft

- Block your debit card

- Get bank statement

- Do cashless withdrawals

- Fund your betting wallet and many more

FAQ About UBA’s Magic Number *919#

- I forgot my pin how do I reset it?

Dial *919# and select the ‘PIN Setup’ option to change or reset your pin.

- How Much does this service cost?

You would have to pay transfer fees and your service provider will deduct N6.98 from your account.

- Are there transaction limits?

With a PIN, the highest amount you can transact within a day is N20,000. With a secure token though, you can transfer up to N1 million. For airtime, you can only purchase or transfer N5,000 per day.

- What networks can I use this service on?

This service is available to MTN, Glo, Airtel, and Etisalat subscribers.

UBA Mobile Banking App

The first step to using the UBA mobile app if you don’t have it already installed on your device is to visit Google PlayStore for android users or App Store for iPhone users to download the app. The UBA app to many people is more convenient than web internet banking and offers more options than the magic number.

How to Register for UBA Mobile Banking

- Download the app, install and launch it on your device

- Open the app, and click on the signup tab

- Select your country and it will bring out options, which you follow to sign up.

- The three options are; UBA debit card, acct number with a secure pass or branch activation code when you go to sign up in the branch

If you have a UBA debit card, you can use it in registering, or you can use the acct number with a security pass. You can only use one method during this registration process. If you encounter any issues, you can always contact the bank through their various contact methods.

Features of The UBA Mobile Banking App

- Transfer funds (Intra and interbank transfers, international transfers)

- Monitor your accounts

- Has personal finance options, where you can create a budget and have savings goals.

- You can set a low balance alert

- View how much you have in different accounts or the total money in your accounts

- Set regular beneficiaries

- Pay bills and utilities

- Buy airtime and data

- Rename account

- Modify language

- Convert from one currency to the other

FAQs About UBA Mobile App

- How Do I recover my forgotten password?

Click on the forgot password tab to reset your password

- How much does it cost to use this service?

This service is free, except when you are transferring funds. Where you’ll be charged per the amount being transferred. Data service charges also apply.

- What are the transfer limits on in-app transfers?

N200,000 is the daily transfer limit on the app. However, to increase it you’d have to get a secure pass.

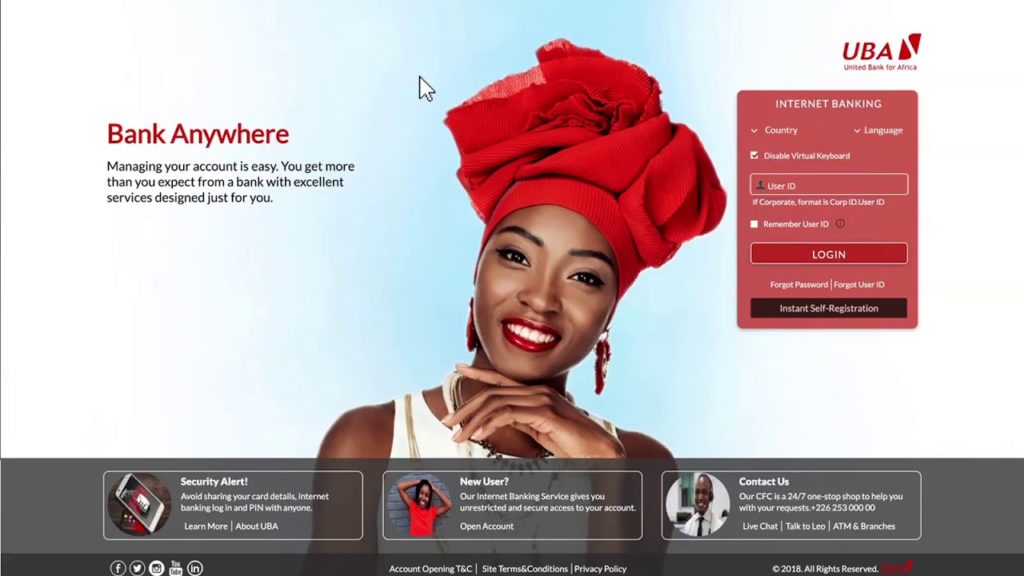

UBA Web/Internet Banking

To have access to this service, you’d need an internet-enabled device. You can perform all the transactions that are also available on the mobile app and even more than what you can perform using the USSD code.

Requirements for Registering and or Using iBank UBA

- You’d need to have an account with the bank

- A debit card

- An internet-enabled phone, desktop, or laptop computer

- Phone number used in opening the account

- Email address already registered with the bank

How to Register For UBA Internet Banking

There are two methods to use in registering for UBA internet banking

- Instant self enrolment

- Registering in a banking hall

Instant Enrollment

- Visit ibank.ubagroup.com and click on the instant registration form.

- It will bring out a menu that would require you to input your bank account number, the first 6 digits and last 4 digits of your debit card, and finally your debit card pin.

- You’d also be asked for a referral ID, though that is not mandatory.

- After filling these, submit, and you’ll get your user ID and password.

- However, if it is unsuccessful, or you have any challenges doing this, you’d have to visit the bank or contact them through any of their various contact channels.

Banking Hall

This is very straightforward. Walk into any UBA branch, tell the staff you’d like to enroll for internet banking, you’d be given a form to fill, and everything will be done right there in the bank.

Features and Benefits of UBA Internet Banking

- Book flights

- Transfers (inter, intrabank and international)

- Account monitoring

- Airtime recharge, data purchase, and bill payments

- View, download, and bank account statement